Multi-currency card.

For you or your business.

One card that is ideal for convenient payments in EUR and more than 160 currencies worldwide. No monthly fees or requirements¹. Always with attractive exchange rates. Top it up and use it, or share it with someone else!

Order a card

You pay in any currency, and we take care of an attractive exchange rate

Don't worry about exchange rates and currency conversion fees when you pay. Your multi-currency card can hold several currencies or just one — whichever is more convenient for you. Do you need a currency you don't have? That's not a problem. Pay with your card wherever Visa is accepted. The funds will be converted at no extra charge

You can have the following currencies on your card:

Polish zloty

Euro

US dollar

British pound

Swiss franc

Thai baht

Emirati dirham

Australian dollar

Hong Kong dollar

Canadian dollar

New Zealand dollar

Singapore dollar

Hungarian forint

Japanese yen

Romanian Leu

The Czech koruna

Danish krone

Norwegian krone

Swedish krona

Turkish lira

Mexican peso

South African rand

Pick a cardto suit your needs

Physical card

In your wallet

- Express delivery by courier and to a parcel locker, or standard delivery by post.

- Payments in stationary shops and online

- Cash withdrawals from ATMs at home and worldwide.

- Just swipe funds from your currency wallet onto your card before paying.

- Pay with your watch and phone, thanks to Apple Pay, Google Pay and Garmin Pay¹.

Virtual card

On your phone

- Use your card immediately after ordering.

- It is ideal for paying for VoD subscriptions or online purchases.

- The virtual card is plastic-free and good for the environment.

- You will never lose it.

- Pay contactless and withdraw cash from ATMs with Apple Pay, Google Pay and Garmin Pay¹.

Physical card

In your wallet

- Deliver directly to your business in Poland and anywhere in the world.

- Use it to pay wherever Visa is accepted and withdraw cash from any ATM in the world.

- You can order an unlimited number of cards and share them with your employees, e.g., during business trips.

Virtual card

On your phone

- Use it immediately after ordering or share it with an employee.

- You can use it to pay for subscriptions to company programs or online purchases in foreign shops.

- The virtual card means no plastic and is environmentally friendly.

Multi-currency cards within your reach

You only need one card to pay at home, online and abroad conveniently. Take control of your balance and save on currency conversion.

Don`t wait to get your physical card. Add a virtual card and pay seamlessly with your phone¹.

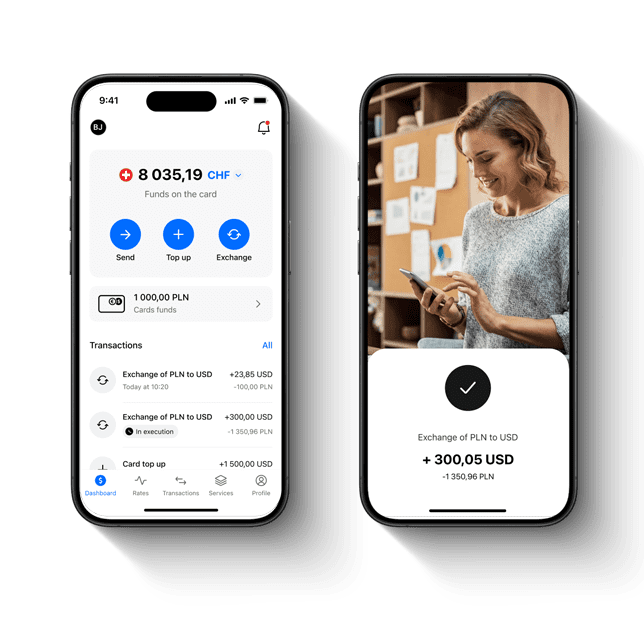

Download Conotoxia app

Transform your smartphone into a financial superpower. Have complete control of your money, wherever you are and whatever currency you need.

- Log in seamlessly from anywhere.

- Track current rates and convert currency at attractive rates.

- Top up your card and control your spending.

Express card top-ups at any time

Before using the card for the first time, top up your currency wallet and instantly shift funds to your multi-currency card. Manage your money freely by moving it from your currency wallet to your card and vice versa when you need.

Find out how it works

Multi-currency card under control

Manage your expenses and set limits. Enable and disable foreign and contactless payments at any time. Shift your funds immediately from your currency wallet to your card and back again. Change your PIN and block or restrict your card when necessary.

Transparent conditions

Everything done online

Forget about complicated contracts and unfavourable conditions. You can conveniently order a card online.

No hidden fees

No more unexpected bank charges for account maintenance and commission for foreign payments. Get free access to accounts in 20 currencies, pay by card, withdraw funds from any ATM and make savings.

No strings attached¹

Put an end to cumbersome conditions and fixed fees for using your card. We do not require regular, minimum deposits or a specified number of transactions. Use your card the way you want to. For free.

FAQ

The card can be ordered by anyone who has an account with Conotoxia.com. If you are not an existing customer, create a free account.

We do not charge you any commission for card payments.

Yes, topping up from your currency wallet is free. Remember to top up your currency wallet and then transfer the funds to your card before using it for the first time.

All fees are indicated in the price list. You can find it here.

No. You can transfer any amount of money from your currency wallet to your card and vice versa. To do this, use the slider.

Yes. You can set your card limits from your User panel or in the dedicated mobile app. If you do not want to keep the funds on your card, you can also shift them back to your currency wallet.

Yes. Our multi-currency card allows you to use Google Pay, Apple Pay, Garmin Pay and Fitbit Pay¹.

Yes. You can do this in the User panel, dedicated mobile app or by contacting our Customer Care Department.

Yes. The app is available for the most popular platforms (Android and iOS).

It can be used for contactless payments, in-store and online payments. With our card, you can easily withdraw money from an ATM. Use it wherever Visa cards are accepted.

The virtual card is ready to use immediately after it has been ordered.

Some foreign ATM operators charge an additional commission for cash withdrawals at their ATMs, a so-called surcharge. This surcharge is independent of the card issuer and is added directly to the withdrawal amount. The ATM operator is obliged to inform the user about the additional commission before executing the withdrawal.

You can check the balance of funds on each card account in the portal or dedicated app. It is not possible to verify the balance at an ATM.

If we receive a refund for a transaction that required currency conversion between accounts, we book it on the account matching the transaction currency. The funds will not be automatically returned to the account from which the currency conversion was made. The transaction will be settled in the same way, if the final settlement will involve a lower amount than the value of the block created when the transaction was authorized. The unused blocked amount will be made available on the account in the currency of the transaction settlement.

Yes. Cash can be withdrawn contactless at ATMs equipped with a contactless reader, using a physical or virtual card, either using your phone or watch. To pay by contactless, you must first add your virtual card to one of the services: Apple Pay, Google Pay, Garmin Pay, and Fitbit Pay.

Apple Pay service protects transactions using security features built into the device's hardware and software. When using Apple Pay, a code and (optionally) Face ID or Touch ID must be set up on the device.

The Google Pay app also has a security system to help detect fraud and counteract hacker attacks (e.g. card data protection, required PIN or other lock).

In the case of Garmin Pay and Fitbit Pay, card data are protected by assigning a unique number to the watch.

Your multi-currency card number is not stored on the device or on servers.

Authorization of transactions at self-service petrol stations takes place before filling up to the amount declared by you or to the maximum amount of a single fueling at a given station. The final amount of your transaction may be lower or equal to the amount of the authorization block. If the settlement is for a lower amount, the unused blocked amount will be made available on the account on which the transaction was settled.

You can get further information about the multi-currency cards in our Help section.

Multi-currency cards are available for Polish residents as well as residents of the European Union (excluding Croatia and Ireland) as well as Norway.

The possibility to share your card with another person is available for multi- currency cards 2.0 available in our offer after 19.12.2022. If you wish to use this feature, please order a new card.

If you want to check how your card transactions are converted, click here. There, you will find information about the exchange rates used. You will also see the margin in relation to the European Central Bank (ECB) rate.

Please note that if you make a transaction in one of the currencies for which we hold your card accounts, it will be settled on the account corresponding to the currency of the transaction.

Order your multi-currency card today

Say goodbye to paying for multiple cards at different banks. Order a multi-purpose card for daily and international payments. Don't hesitate! Start saving now.

Order a card