The Scandinavian central banks have decreased interest rates, in order to protect their own economies from excessive enforcement of their currencies. The Polish exporters became a victim of such actions. The sale of the national products on these markets has decreased since the beginning of this year.

PDF Download (175.4)

The main Polish products exported to the Scandinavian countries, are from electrical-engineering and the car industry. Food, raw wood materials and chemical products are also exported.

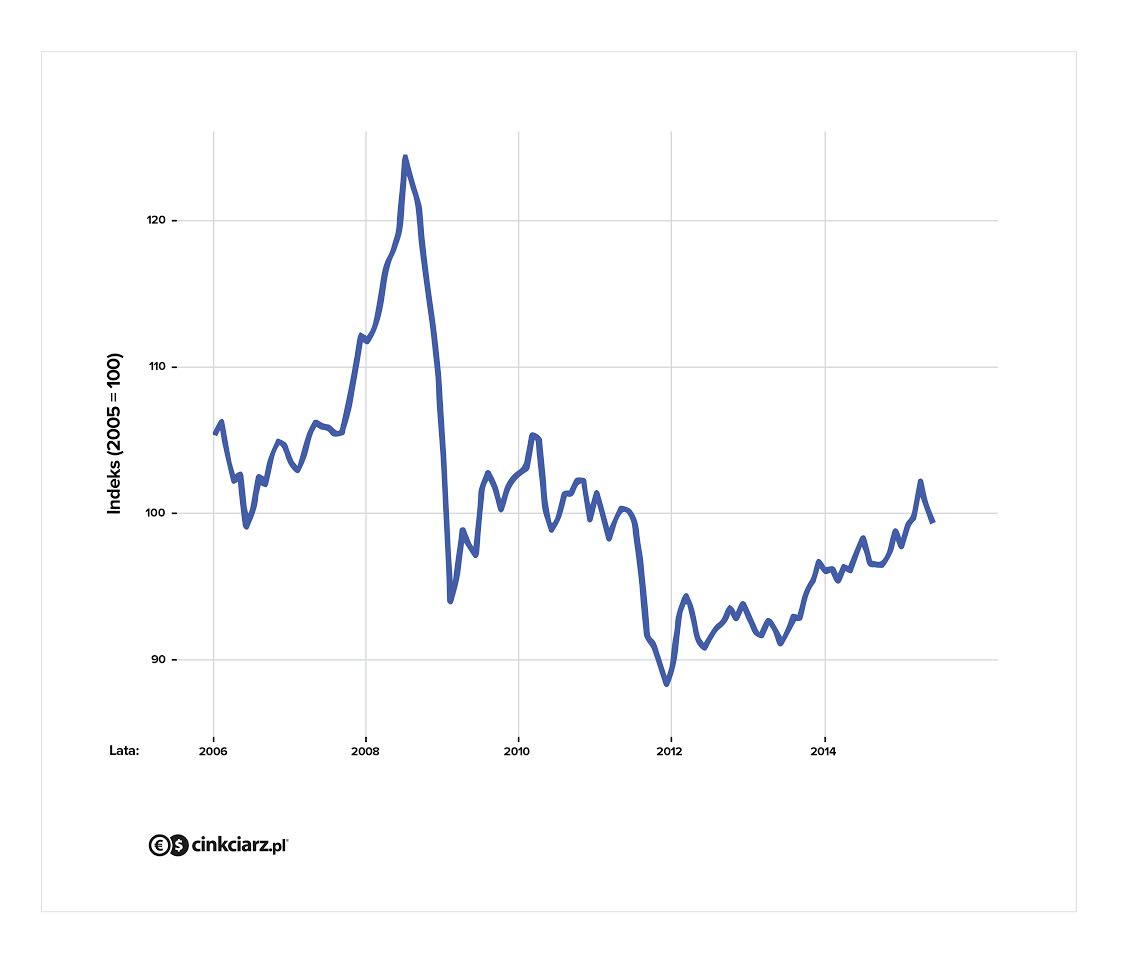

However, the export of Polish products to Scandinavia has decreased since the beginning of 2015. Sales in April decreased to the level of 2.9% in relation to last year. It was the worst result since 2006. This tendency has intensified every month. Additionally, the contribution of these countries in Polish export has decreased. IIn December it was 7%, and decreased to 6.5% in April.

Export to the Scandinavian countries (a year to year change).

Source: GUS. Analysis: Cinkciarz.pl

Source: GUS. Analysis: Cinkciarz.pl

The very weak result in export to these countries is caused by a strong decrease in sales to Norway. It is 27% lower than last year. We are however dealing with an increase when it comes to other Scandinavian countries, but it is definitely slower than previous years. Also, the analysis regards the region as a whole.

Why is this happening?

In mid 2014, the Scandinavian countries experienced problems caused by a collapse in oil prices (a decrease from approximately 100 dollars, to currently approximately 50 dollars). This made it a necessity to limit the investments in the mining and petrochemical sectors.

However, since the beginning of 2015 there has been no sight of a decrease in the export of Polish products from the electrical-engineering industry, which are used in the mining sector (it has generally increased by 12.2%, with the only decrease in sales to Norway). On the other hand, a limitation in the export of price sensitive products is visible.

This means a clearly slower increase in the sale of products made of wood and from the chemical industry. Worse results are also seen in some categories of groceries. This may show that the limitation of export of these products is a result of the high prices determined by the enforcement of the zloty.

Method for strong currencies

At the beginning of 2015 the European Central Bank began to purchase government bonds in order to support the economy and revive inflation in the eurozone. The inflow of the cheap euro on the global markets forced the countries with their own currencies to respond. Thus, since the beginning of the year we have observed a wave of decreases in interest rates, which have very often reached record low levels.

The last few weeks have brought another round of cuttings. On 2 July the Swedish central bank (Riksbank) unexpectedly cut interest rates by 10 base points to minus 0.35%. Additionally, the monetary authorities decided to increase the purchase of government bonds.

Riksbank's decision was quite a surprise. The condition of the Swedish economy is relatively good. The central bank excused the decrease in interest rates with the uncertainty related with the Greek crisis and its impact on currency rates. Recently a clear enforcement of the Swedish krona has been observed. By that, the Swedes directly admitted that they are fighting for a weaker currency.

A few weeks earlier (18 June), similar actions were undertaken by the Norwegian central bank, Norges Bank. Interest rates were cut down to a record level of 1%. However, in comparison to Sweden the condition of the Norwegian economy is much worse. Norway experienced greater harm due to the decrease in the price of oil. Recently, this raw material has been losing value again. This increases the likelihood of more cuts, which will result in the further wear off of the Norwegian krona.

Denmark is a special case. In this country the krona is strictly related to the euro. After the EBC decision about beginning the bonds' purchase, Denmark used the negative interest rates in order to prevent its' currency rate from tearing it away from the euro. From the Polish perspective it means that the Danish currency behaves in relation to the zloty the same as to the euro.

The last country, Finland, is a member of the eurozone. The rate of the common currency is of crucial significance and it is quite stable.

Strong zloty withholds export

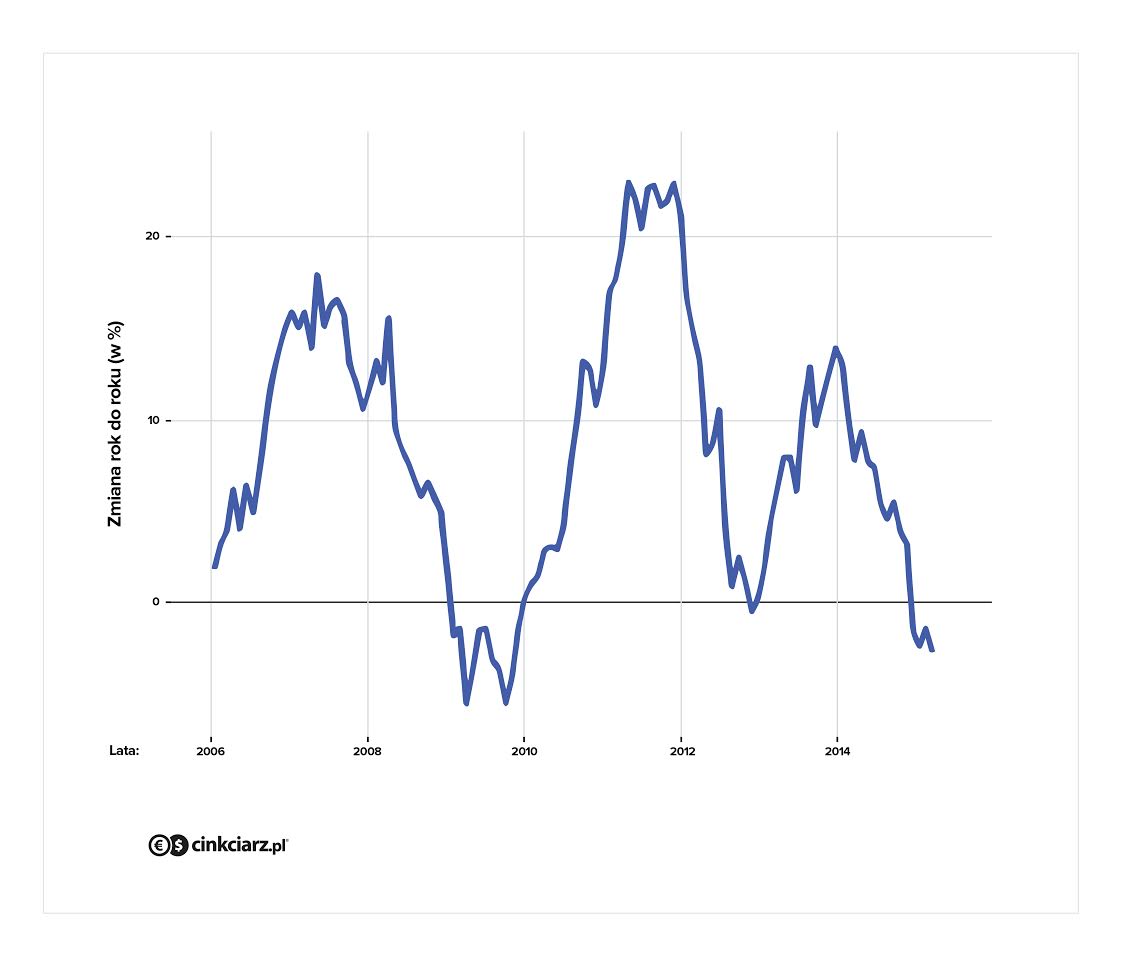

The Cinkciarz.pl SCAN* index of the zloty for the Scandinavian countries, shows that we are currently dealing with a period of a strong zloty. In June, it was 1.9% higher than the previous year and in the previous month it was 4.4%.

Depreciation of the index by 1% in June in relation to the previous month, is not of great significance at the moment. The increase trend of the SCAN index has lasted since the beginning of 2012. After the decisions of Riksbank and Norges Bank, it is difficult to expect this tendency to be stopped. The situation is worse only in the case of countries of central and eastern Europe.

The Cinkciarz.pl SCAN index of the zloty.

Export to the Scandinavian Countries is as intensive as export to the United Kingdom, which next to Germany is Poland's most important trading partner. Therefore, a decrease in sales to these countries will be reflected in the deterioration of the balance of Polish trading. This will impact a decrease in the growth of the GDP.

Scandinavian central banks' response to the EBC actions is another stage of attempts to wear off the national currencies in order to improve its own competitiveness.

At the beginning of June, Angela Merkel spoke about the possibility of returning to similar solutions. The German chancellor estimated the strong euro as a danger to increase such economies as Spain or Ireland, which are dealing with the budget problems. During the G7 summit a few days earlier, it was said that Barrack Obama had mentioned the strong dollar as harmful for the American economy, although later he denied these words.

A decrease in export to the Scandinavian markets, shows how significant it is to care about the price competitiveness of products.

*Szczegółowe informacje o indeksach walutowych Cinkciarz.pl są dostępne tutaj:

https://conotoxia.com/news/daily-analysis/the-zloty-index-by-cinkciarz-pl-june-2015-part-1

https://conotoxia.com/news/daily-analysis/the-zloty-index-by-cinkciarz-pl-june-2015-part-2