Greek bankruptcy, Fed's interest rates raise and further fall of the petrol oil prices can shake things up on the financial markets. This strongly negative scenario may be fulfilled and the franc may soon cost 6 PLN - warned Piotr Lonczak, Cinkciarz.pl analyst.

PDF Download (164,7 kB)

'Franc at 2 PLN? Quite possible' - wrote Marcin Lipka, Cinkciarz.pl analyst a couple of weeks ago. Indeed - the Polish currency has potential to strengthen against the Swiss franc in a couple-year-perspective. It is due to the fact that the Swiss currency is 40 per cent overpriced.

The problem is, however, that this instant we are at the beginning of resigning from the anti-crisis policy. It is hard to predict how long this will take and how many problems will occur on the way. At the same time, it is clearly visible that there are many sources of doubt, hence the danger of the franc strengthening again in a year. This could happen independent of the optimism regarding the weakening of the Swiss currency in the couple-year-perspective.

The zloty vulnerable to risk

The zloty is regarded as a currency from one of the emerging countries - just as the currencies of Georgia, Turkey or Mexico. As a consequence of this fact, it is vulnerable to the moods of the investors. It means that the zloty goes up if the sentiment is good on the markets, that is when there are increases in stock market indices observed and goes down during increasing risk aversion, that is during falls. The franc is a different story. The Swiss currency is regarded as a safe capital investment, which means that its rate goes up during worse moods on the markets.

Below, there are possible flashpoints listed which can make the franc very expensive. There is also a simulation of the franc's rate, which assumes fulfilling such a risky scenario.

Fed raises the rates

In March, the Federal Reserve has cleared its path towards raising the interest rates. The first increase of the credit's cost in the USA since 2006, will be an impulse to redirect the investment strategy. A chance for higher earnings might encourage some investors to withdraw the funds from the emerging countries - also meaning Poland - and invest them in American assets (e.g. stock and bonds).

A consequence of this should be the overpricing of currencies from the emerging countries - including the zloty. A similar situation occurred in May 2013. The Fed did as little as suggesting putting an end to bonds purchase and caused outflow of the funds from the emerging economies.

Even cheaper oil

The fall in crude oil prices to the lowest level since 2009 causes some serious tension among its exporters. Russia and some of the OPEC countries have already experienced some severe difficulties. The reduction of the budget income, along with the decrease of the currency's value means that economies, which are oil-dependent experience the GDP fall and rapid inflation growth. It is caused mainly by the increase of the value of the imported materials.

Regarding the economic difficulties of Russia, the conflict in Eastern Ukraine is also relevant. An increase in its severity might make Moscow redirect the society's attention from the political issues towards the economic ones. If Kremiln decides to increase its involvement in Donbas, then deeper destabilization will be an additional source of the zloty's weakness.

Bankruptcy of Greece

In February this year Greece reached an understanding with its creditors. All parties agreed that the country will receive money from the help programme in exchange for the promise of the continuity of reforms. It has been established that the issues between Athens and Brussels are resolved. It was assumed back then that the issue will not be reviewed at least until the middle of the year as the money was supposed to be supplied for four months.

However, it quickly turned out that the government of Alexis Tsipras was not very eager to follow the arrangements and aimed at reversing the labor market reforms and retirement system as well as stopping the process of privatisation. Greece also tried to prompt its creditors to make concessions, which was criticised especially heavily by Germany.

However, it seems that this time an agreement will be reached, although financing only for a few months means that this problem will reoccur. The patience towards Athens may vanish in time and this could discourage the eurozone counties from making any concessions. There is a possibility that the Syriza government, unsatisfied with the adamant attitude of Troika (experts from the European Commission, International Monetary Fund and the European Central Bank) will seek help in Russia. In January, similar speculations were belied, but after the series of failures in Brussels, Athens may look towards Kremlin one more time.

Since the beginning of its office, the Alex Trispas government said that reconstruction of the debt is possible. Today, it cannot be ruled out that Syriza will make a decision about the suspension of servicing the debt to its European partners and getting credit from Moscow.

SNB will bow down again

In January the Swiss National Bank gave up capping the franc and keeping the rate of EUR/CHF above 1.20 franc. This policy, exercised since September 2011, was replaced by intervensions aiming at keeping the euro rate in the 1.05 - 1.10 franc interval. The difference is, the SNB did not officially present a satisfactory interval.

Such interventions, which goal is to weaken the domestic currency, has no limits technically speaking. However, it has some very harmful side effects. The situation led to an increase in real estate prices, which slowly shows the characteristics of an economic bubble. The SNB doesn't want to let the housing crisis of the early 90s to be repeated, so this could make it put an end to the interest rate decreases. This would be a factor supporting the franc.

Franc at 6 PLN

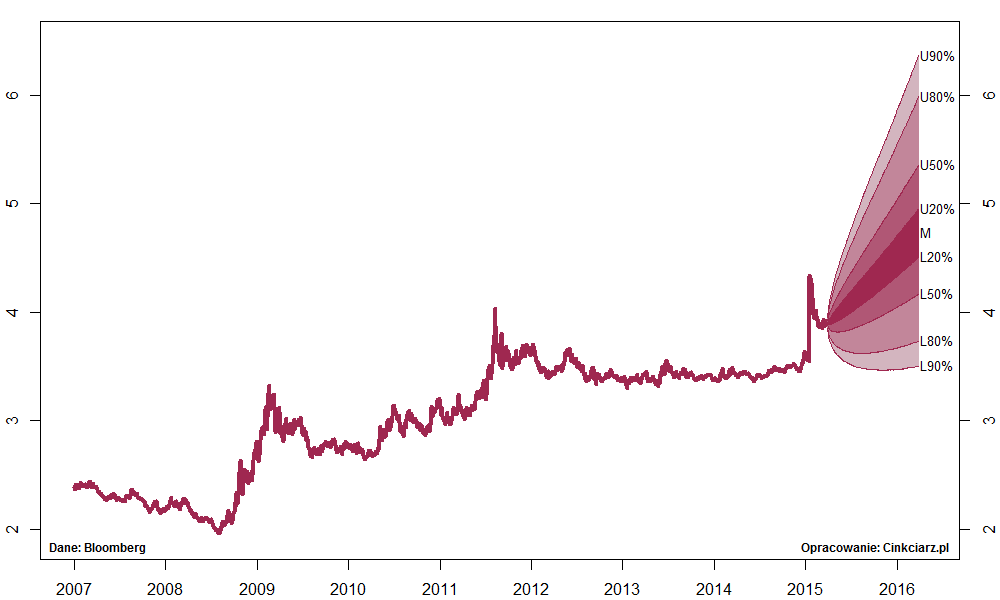

The simulation of the franc's rate in the risky scenario assumes that the CHF/PLN rate movements would resemble these from the years 2008-2011.

Since the outburst of the crisis in 2008 until the SNB capping the EUR/CHF rate in September 2011, there was a crash on raw material prices, escape of the capital from the markets of the emerging countries and the beginning of the Greek problems. Today's circumstances, then, are quite similar to these before.

The simulation of the franc rate was conducted assuming, that the daily rate changes reflect those from the years 2008-2011. The chart shows the simulation for the next 260 days and the forecasts' intervals. There is 20 per cent probability that the CHF/PLN rate will reach 4.51 - 4.95 interval, 50 per cent probability it will reach 4.17 - 5.35, 80 per cent for 3.73 - 5.99 and 90 per cent probability for an interval 3.50 - 6.37. The probability of the CHF/PLN going above 6 PLN is 10 per cent, and above 5 PLN - 40 per cent.

The fact of reoccurrence of the circumstance means that in one year's perspective the franc may rise up to 5 PLN, and, assuming the extremely unfavorable scenario, even up to 6 PLN.

Justified anxiety?

Even though, the Fed has begun the process on the monetary policy standardization (that is, resigned from bond purchase and gave up the zero interest rates) may cause much tension in the few coming quarters, in a few years' time it should be a positive sign for the global economy. A higher demand over the ocean stimulates the investments in the emerging counties. There's only a few steps to the situation in which the capital which is currently seeking safety in the franc, started to look for higher growth rates on the emerging markets. This would mean the fullfillment of the scenario set forth by Marcin Lipka.

The experiences with forecasts for the Swiss franc proved that no option should be excluded, even if the probability of it coming to life today seems very low. The optimistic scenario is possible in the next few years. However, currently, it is only the beginning of the road to stabilization, which, without any doubt, hides many surprises. Therefore, when creating financial plans, one should also consider the situation, where things could go sour.