In the era of widespread internet access and fast-growing cross-border e-commerce, we are more and more often choosing to shop in foreign online shops. Not only are we tempted by special prices, but also by unique products not available at home. However, how to pay in foreign currencies without losing out? We present a way to save up to 9.5% of the transaction amount - paying for orders with a multi-currency card.

Table of contents

Do not be fooled by the price in your home currency

When we shop abroad, we often see prices in our local currency. This is convenient - we know immediately how much we are paying and do not have to worry about currency conversion.

In reality, however, foreign online shops accept payments in, for example, dollars and show shoppers the amount with currency conversion charges already added. Due to unfavourable exchange rates with a frequently added high margin, the final price is only attractive from the seller's point of view.

It turns out that if we change the displayed currency on a shopping platform to, for example, US dollars, and then pay with a multi-currency card in that currency, the final cost of the transaction is lower. In some cases, the savings can be as much as several percent.

Paying with a typical payment card in a foreign currency - is it worth it?

Nowadays, almost everyone carries a card in their wallet that can be used to pay in a foreign currency. We are talking about ordinary debit cards, for example. When placing an order in a foreign shop, all you need to do is enter the card number and pay for the transaction. When you access your account history, you will see that the bank has charged the amount in Polish zloty, for example, even though the product purchased was priced in US dollars.

Does this mean that this payment method is cost-effective? Not necessarily. Banks use their own exchange rates when making transactions settled in foreign currencies, which may differ significantly from the quotes offered by, for example, online currency exchange offices. They may also charge additional fees and commissions related to currency conversion.

Although this way of paying is convenient, it can ultimately generate additional costs. These can easily be avoided.

How to save up to 9.5% on shopping in foreign shops?

With a Conotoxia multi-currency card, you can pay in more than 160 currencies at attractive exchange rates. Thanks to it, we will also avoid additional currency conversion commissions. The requirement, however, is that the payment is made in the shop's default currency (usually the US dollar or the euro).

How much can be saved this way? Quite a lot. Let's say we want to buy trousers for 36.99 EUR on a foreign auction portal. Paying with a debit card issued to an account held in the Polish zloty, offered by one of the leading banks in Poland, we would pay 186.65 PLN. Using a multi-currency card from Conotoxia, the final amount would be 174.20 PLN, i.e. 7.15 % less.*

The savings can be even greater with less popular currencies. Using a debit card issued to an account held in the Polish zloty in a Norwegian online electronics shop, we would end up paying 234.89 PLN for a router costing 499 NOK. If we had used Conotoxia's multi-currency card, the purchase would have been much cheaper, at 214.52 PLN. In this case, the difference is as much as 9.50%.

Making regular use of the solution from the Polish-based fintech, Conotoxia, in a way, we organise special promotions for ourselves. With the average foreign shopping basket of Poles worth 379 EUR (Report "Poles shopping, 5 pillars of modern commerce"), the savings from paying with a Conotoxia multi-currency card may amount to more than 166 PLN per year.

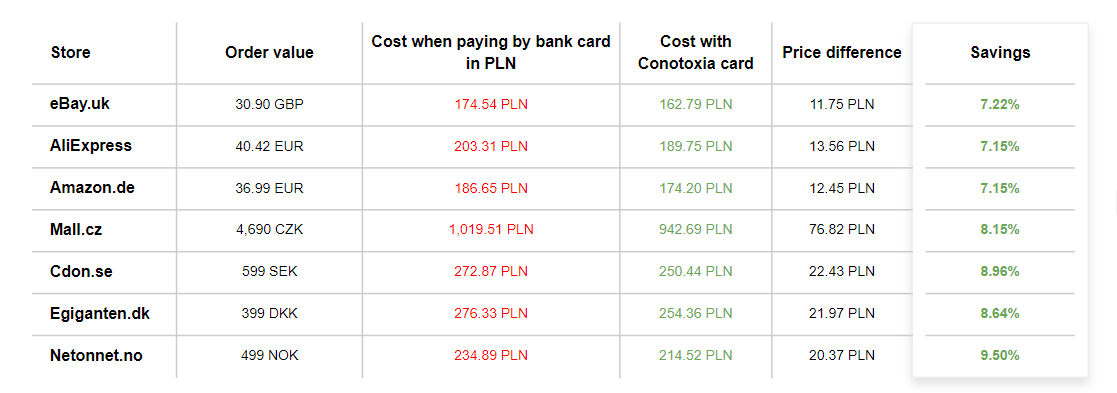

Examples of savings are summarised in the table:

Source: Internal analysis of Conotoxia. Currency rates are as of 3.02.2023.*

What does a multi-currency card offer?

The Conotoxia multi-currency card enables easy payments in more than 160 currencies at favourable exchange rates. It can be used to pay for online transactions but also in stationary shops, e.g. during a holiday trip.

The card is available in two versions - a physical one that can be carried in a wallet and a virtual one that can be accessed both in the web portal and the app. Each can be connected to Google Pay, Apple Pay, Garmin Pay or Fitbit Pay and can be used to pay contactless with a phone, watch or sports band.

There are no additional fees or commissions for foreign currency payments. During the transaction, the card automatically recognises the currency and withdraws the funds from the corresponding balance or performs a currency conversion at the attractive Conotoxia exchange rate.

The user also gains access to 20 free currency accounts as part of the account. They can manage their accumulated funds in an intuitive mobile app, exchange currencies at any time or transfer money from currency sub-accounts to the card.

*The analysed exchange rates and currency conversion fees are as of 3.02.2023 and were taken from the currency converters available on the websites of the calculators for cross-border transactions of the two leading banks in Poland. Compared with the cards offered by these banks (Visa Zblizeniowa debit card and Mastercard debit card), transactions carried out using the multi-currency card offered at Conotoxia.com were more favourable. The article and the table present the results of one of the analysed banks that offered less favourable currency conversion. The cost of currency conversion for Conotoxia.com comes from the currency converter available on this web portal.