Nearly 72% of Polish e-commerce entrepreneurs expect a revenue increase in 2024 compared to 2023. What should Polish stores that plan to sell abroad pay particular attention to? What are their prospects and challenges? Answers to these and many other questions can be found in the latest report on global e-commerce, prepared by fintech Conotoxia.

Macroeconomic environment of the e-commerce industry

Central banks on the Old Continent are trying to smother inflation, which has backfired in the wake of the coronavirus pandemic and Russia's military invasion of Ukraine. The cycle of interest rate hikes in both the Eurozone and Poland is bearing fruit. The momentum of price dynamics is clearly slowing down. At the same time, the sentiment of European businesses and households is improving. In fact, consumption emerges again as one of the driving forces of economic growth. Retail sales data from the second half of this year confirm the change in trend.

It is a highly significant signal for the fast-growing e-commerce industry, in which Polish merchants are becoming more and more bold in setting new directions for foreign markets. The stakes appear to be high, as the value of online sales across Europe - according to estimates by Ecommerce Europe - is already approaching the 800 billion EUR barrier, and products can be offered to nearly 600 million residents.

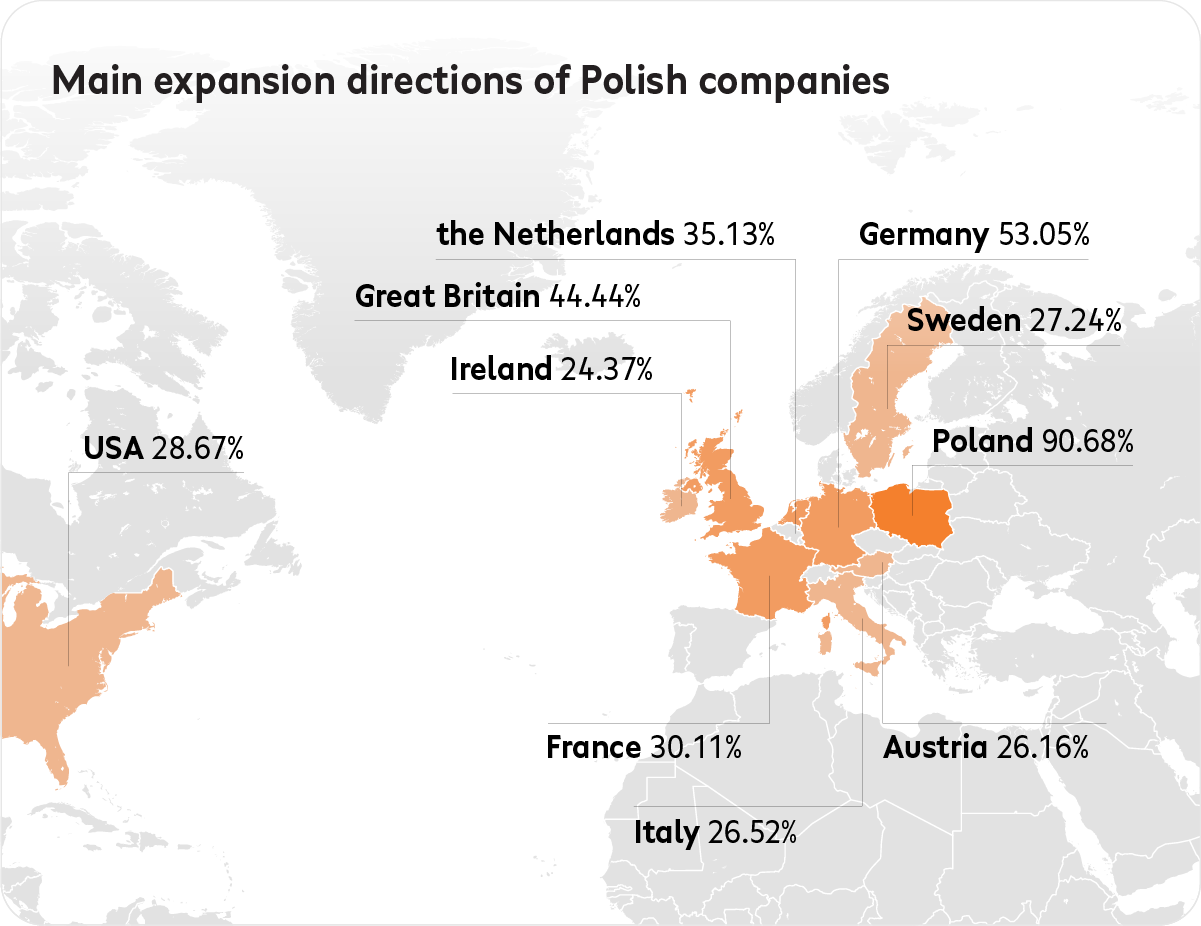

Cross-border e-commerce - main expansion directions of Polish stores

Polish online stores are eager to make their goods available abroad. As many as 74.9% of those surveyed are trading abroad. The largest number of companies open to the German market, 53.05%, while 44.44% allow purchases to customers from the UK, and 35.13% try to establish a presence in the Netherlands. The next places on the list of the most popular directions for foreign expansion of Polish e-commerce representatives are France - 30.11%, the US - 28.67%, and Sweden 27.24%. The markets of Hungary or Slovakia enjoy relatively little interest, with around 11-13% each, and almost marginal interest in Iceland and Bulgaria with 9-10% each.

Payment methods for foreign sales

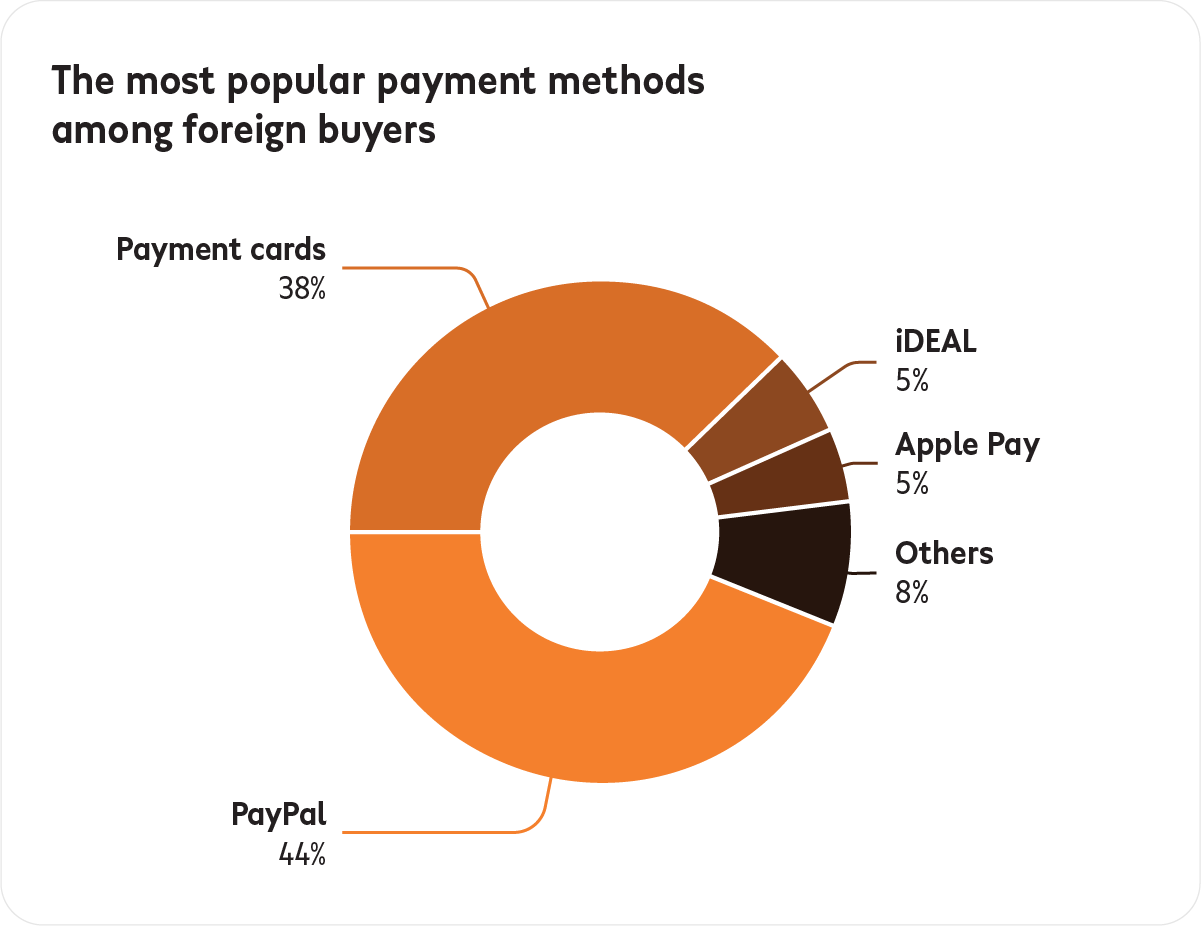

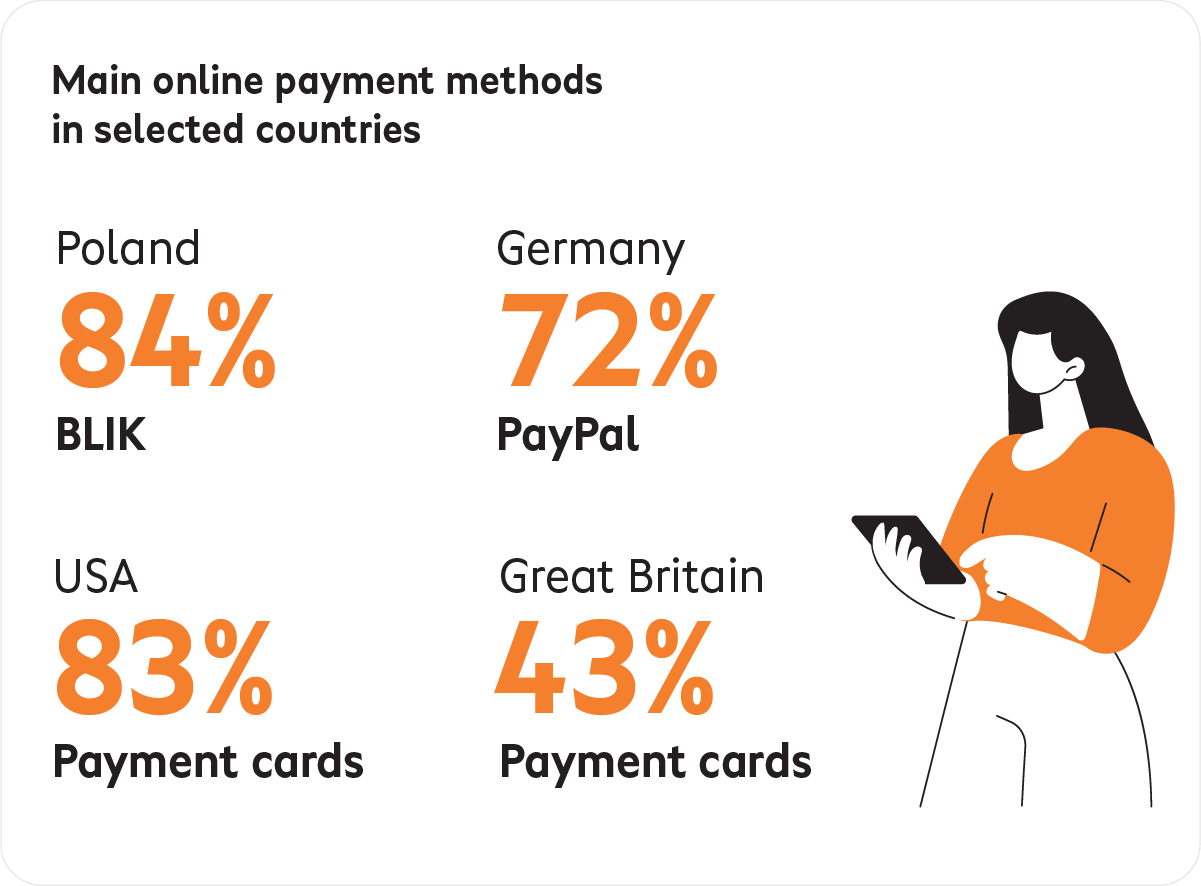

For online shoppers, it is not only the prices, choice and quality of the products available online that matter. Payment methods offered by sellers also prove to be important. The Conotoxia report shows that while in Poland, BLIK is the undisputed winner (as much as 84% of transactions are made using this method), consumers outside Poland most often finalise transactions using PayPal (44.05%) and payment cards (37.83%). Providing payment methods adapted to the specifics of a given market is an element which plays a crucial role in planning international expansion.

Things get even more interesting when looking at the preferences and choices in individual countries. For example, it is not worth setting out to conquer the Dutch market without the iDeal method, which is the most popular choice among internet users in this country. Interestingly, in the US, card payments enjoy similar success (over 83%) as BLIK in Poland.

Challenges and prospects for cross-border e-commerce in 2024

What are the outlook and expectations of Polish entrepreneurs for 2024 in terms of foreign expansion? They are dominated by optimism. As many as 71.8% of respondents expect an increase in revenue compared to the passing year 2023. Only 1.5% of the surveyed expect a decrease in revenue, while a year ago, such a scenario was declared by 7.1% of respondents.

The expectations of the Polish e-commerce industry are in line with economic forecasts. "The macroeconomic environment for the e-commerce industry has been exceptionally challenging in the past quarters, but this should now be improving. The Polish economy is not the only one whose condition will definitely recover in the near future. The Czech Republic, Lithuania, Latvia, Hungary or Bulgaria are the countries in which the GDP dynamics in 2024 should also accelerate to about 2.5%. Romania will develop even faster. By contrast, in the euro area, the growth rate, which in 2023 will be around 0.5%, will still not exceed 1% the following year," predicts Bartosz Sawicki, Conotoxia analyst.

What are the main challenges for Polish entrepreneurs aiming to strengthen their position on foreign markets? 53% of those surveyed declare increased investment of time and resources in marketing activities, 19% in logistics, 11% in selecting appropriate payment methods, 9% in product development and 8% in additional language versions of the online shop.

Payment system ideal for cross-border e-commerce

The report "Global e-commerce in 2024 — Business opportunity or challenge for Polish companies?" was conducted with the participation of entrepreneurs using Conotoxia Pay, a payment gateway created for entrepreneurs opening up to foreign markets. The intuitive, fast and secure system allows online shops to accept payments in 27 currencies, including all of the world's most popular and important currencies. What's more, many payment methods are available in Conotoxia Pay. These include fast online bank transfers, BLIK, cards (including Visa, Mastercard, Diners Club), PayPal, Apple Pay, Google Pay, Trustly, Skrill, Vipps, Rapid Transfer, iDEAL and others.

Payment screens for those paying using Conotoxia Pay are available in Polish, English, German, French, Spanish, Italian, Czech, Romanian, Norwegian and Dutch.