Today is an anniversary of a rapid franc hike. This is a memorable date not only to the debtors, but also analysts. As it turns out, it was the largest one-day movement of a currency of a country since introducing liquid rates in the 70s. At times the movement was as much as by 40 percent. Just how overvalued is the franc? Marcin Lipka, Cinkciarz.pl currency analyst, addresses the matter.

For a year now the economists have been discussing the scale of overvaluation of the Swiss franc (CHF). A hint to resolve this issue is the recent comment from the vice president of the Swiss National Bank (SNB), Fritz Zurbrügg. Last Wednesday (January 13) he presented a document about the competitiveness of the Swiss economy, publishing an important illustration of the changes. It shows the scale of the overvaluation of the franc.

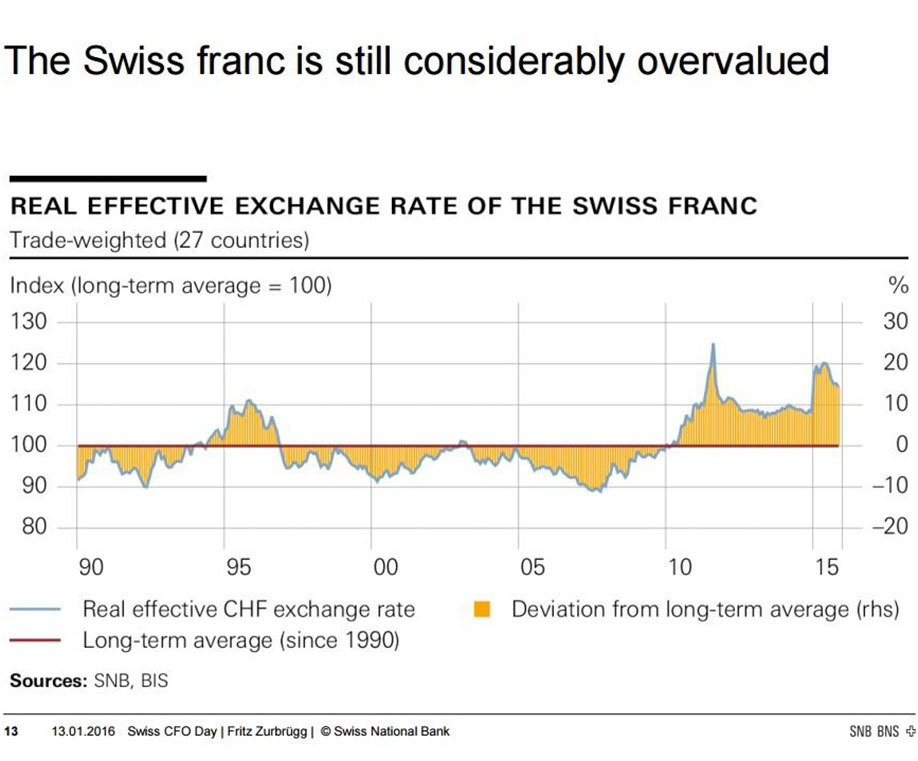

Throughout the last 25 years the franc rate in relation to the currencies of 27 largest trade partners of Switzerland including inflation (REER) was within the levels of from 10 percent undervaluation to 20 percent overvaluation. The undervaluation was calculated on the basis of the deviation from the approximate rate of REER during the last 25 years. It is a good method used by the vice president of the Swiss National Bank as it enables to include not only the nominal changes and the inflation in Poland and abroad in the currency rate, but also changes to the competitiveness of particular currency territories. This last element is one of the main factors to shape the value of the currency in long term.

The real effective rate of the Swiss franc

- Source: the Swiss National Bank

- The blue line: real effective rate of CHF . The red line: an approximate REER rate since 1990. The yellow area presents the scale and length of the under- or overvaluation period.

The deviation of the franc by 15 percent from the approximate REER rate shows that the Swiss currency is overvalued, taking into consideration the fact that both the inflation in Switzerland (lower than outside its borders), and the fact of higher competitiveness of the Swiss economy. How fast can we return to the balance?

This depends on two factors. Firstly, the shape of the global economy and how long the Swiss National Bank will be lowering the currency rate by intervening on the market as well as keeping the negative interest rates of the deposits at minus 0.75 percent on annual basis. If in the coming quarters it turned out that the global situation improves, then it can be anticipated that the capital will outflow of Switzerland both from the local investors and the investors abroad. They will also look for the higher return rate outside the country.

The capital outflow along with the Swiss National Bank actions will enable for returning of the franc to the balance level and its devaluation by 15 percent in relations to the currencies of the most important trade partners. This would probably allow for a similar fall of the franc. In this scenario it can be expected that the franc will be at 3.4 PLN.