Author: Bloomberg.com

Address: http://www.bloomberg.com/forecaster-sees-rajan-benign-neglect-weakening-rupee-to-70

Published: 12.04.2016

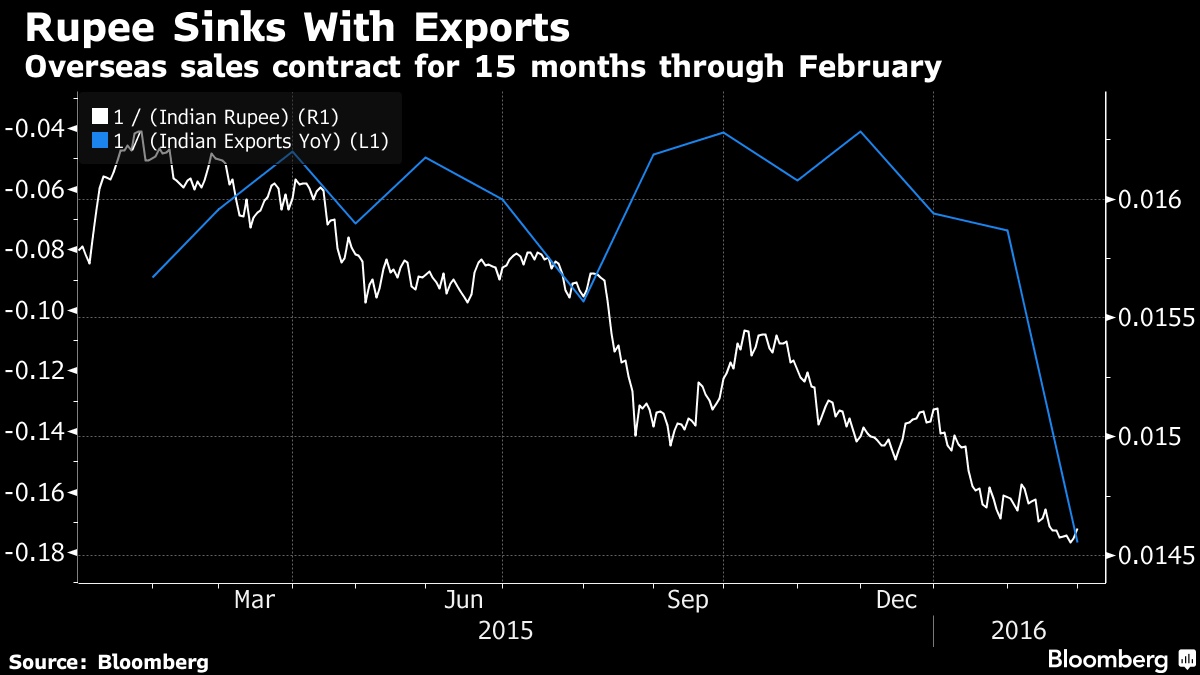

The top forecaster for India’s rupee says central bank Governor Raghuram Rajan will allow the currency to slide to a record low this year to help arrest a slump in exports.

The rupee will drop 5 percent to an unprecedented 70 by the year-end, according to Credit Agricole CIB, which had the most accurate estimates in Bloomberg’s surveys over the past 12 months. Cinkciarz.pl and BMO Capital Markets, ranked second and third, see a decline to 68 by the end of December. The currency has weakened 0.5 percent to 66.5050 in 2016 after depreciating 32 percent in the last five years.

- Source: Bloomberg.com

“Governor Rajan is treating the value of the rupee with benign neglect as long as it doesn’t fall out of bed, which it isn’t,” said Dariusz Kowalczyk, a Hong Kong-based senior emerging-market strategist at Credit Agricole. “Simply put, I believe that Rajan wants a weaker currency without admitting so, because he prefers to stimulate growth via boosting exports through rupee depreciation than via boosting domestic demand through lowering interest rates.”

"Beggar My Neighbor"

Rajan, who last month argued against the “beggar my neighbor” strategy of competitive devaluations, may accept further weakness against the dollar as the central bank’s gauges show the rupee strengthening against currencies of main trade partners. That’s eroding the competitiveness of India’s exports that have contracted for 15 straight months. At the same time a rebound in global oil prices threatens to spur inflation and limit the Reserve Bank of India’s scope to spur growth by cutting rates further.

While the rupee is Asia’s worst performer versus the greenback this year, it was 21 percent overvalued against the exchange rates of India’s six largest trade partners at the end of March, according to an RBI-compiled trade-weighted index.

“The RBI is very mindful of the relative value of the rupee due to export competitiveness concerns,” Kowalczyk said. “Poor export performance has been a menace to India’s economy, and the RBI will definitely tolerate rupee depreciation to help exporters as long as the depreciation is orderly.”

The median estimate in a Bloomberg survey of 35 strategists is for the Indian currency to weaken to 68 a dollar by Dec. 31.

March Bounce

Cinkciarz.pl predicts the rupee will strengthen to 65 through September as India’s current-account deficit remains in check, before weakening to match the consensus estimate by the end of the fourth quarter. The currency jumped 3.3 percent in March, the most since September 2013, as lower inflation and the government’s pledge to maintain fiscal discipline attracted $4.1 billion of inflows to local stocks.

“Some later weakness is caused by the expected strength of the dollar at the end of the year,” said Marcin Lipka, a Warsaw-based analyst with Cinkciarz.pl. “It is not a result of any weaknesses of the Indian economy or a loose monetary policy.”

While the shortfall in the broadest measure of trade narrowed to $7.1 billion in the three months through December, from $8.7 billion in the previous quarter, it was more than double the $3 billion median estimate in a Bloomberg survey of 15 economists. The gap was 1.3 percent of gross domestic product. Cinkciarz.pl expects it to narrow to 1 percent in coming quarters.

Fed Risk

The current-account deficit is largely funded by portfolio inflows, which could reverse when the Federal Reserve raises interest rates, according to Credit Agricole. The bank expects rising oil prices to increase India’s import costs and widen its trade deficit, weakening the rupee. Global funds have reduced their holdings of Indian bonds by 45 billion rupees ($678 million) this year as Rajan’s monetary easing diminished their appeal.

The rupee “is particularly vulnerable to Fed rate hikes, of which we see two this year, and resulting appreciation of the dollar,” Kowalczyk said. “Its recent rally against the dollar seems to have run its course, leaving the currency vulnerable to a correction.”