The zloty strengthening is unfavourable to the trade balance. The Polish currency is growing faster compared to the export countries rather than to the import countries. As a result, maintaining the trade surplus is threatened.

PDF Download (175.5 kB)

Since the beginning of the political transformation in 1989, Poland’s aim is to become an export country. An inspiration to it is the economic growth of Germany, built on the strong position of the export companies all over the world. Because of this many politicians and economists are certain that copying the economic model of Poland’s Western neighbour would open a path to an equally high level of living.

After a temporary drop, the export value during the world crisis (2008), selling goods abroad has been raising constantly since 2009. Poland is a top European exporter of cards and components for the automotive sector. We have a strong position as a provider for the electromechanical industry products. Also food export is becoming more and more important. The years following the criis have shown that the Polish entrepreneurs managed to adapt to difficult conditions and were able to make a strong competition to the worldwide companies not only by their prices, but also with product quality.

The success would be even bigger if the zloty rate was more favourable to the companies. The Cinkciarz.pl Zloty Index shows, that the Polish currency has been strengthening against its most important trade partners since 2012 and the trade deficit is steadily decreasing. The raising zloty rate weakens the price competitiveness of export, which makes the Polish products more expensive for clients abroad.

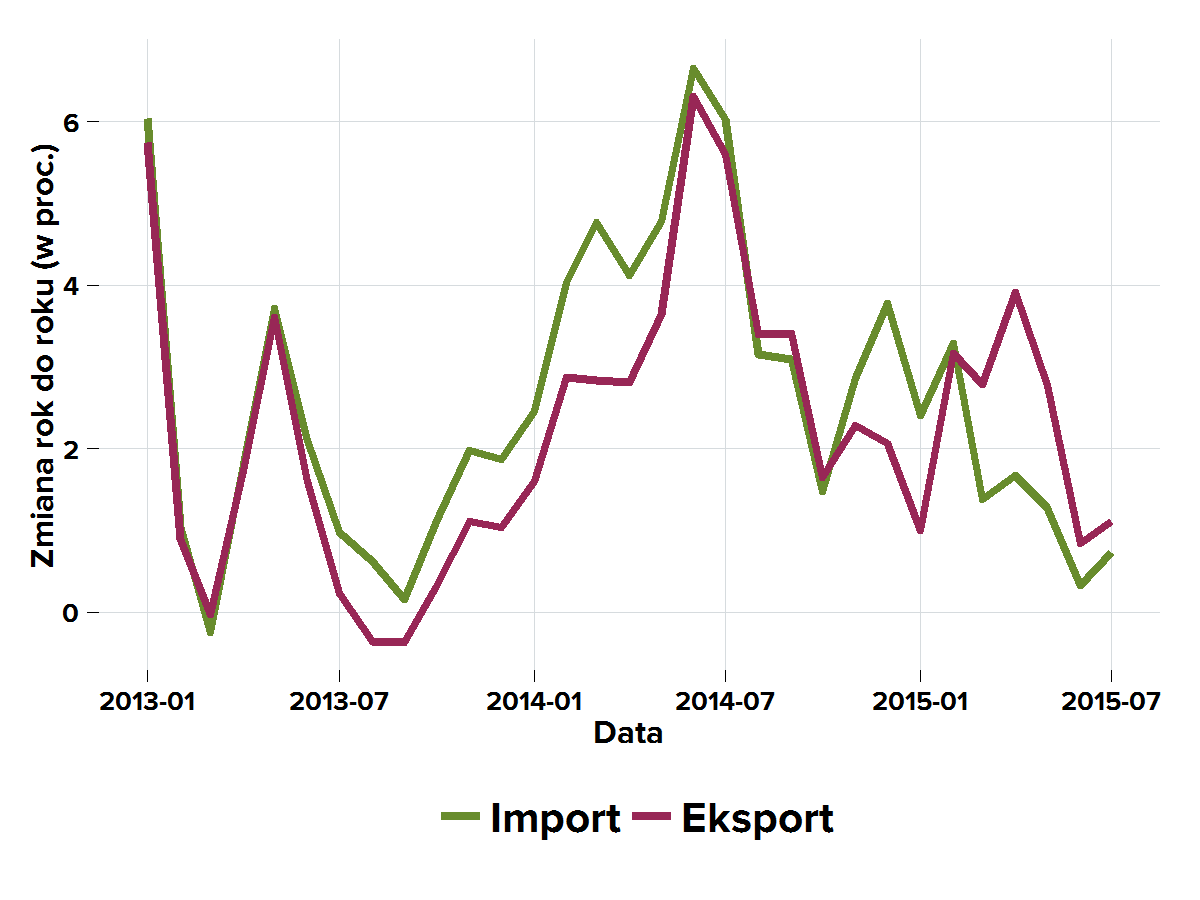

- The Cinkciarz.pl Zloty Index compared to the key export and import partners (year on year). Source: Cinkciarz.pl

Since the middle of 2014 the value of the zloty has been raising relatively slowly compared to the currencies of the countries who are Poland’s key trade partners (green line). Moreover, the zloty has strengthened at a faster pace in relation to the currencies from the countries to which Poland is exporting (bordeux line).

This means that the prices of the Polish products for the foreign clients have gone up quite quickly, which might lead to a drop in sales. From the perspective of the Polish companies, the price of the products purchased on foreign markets are decreasing at a slower pace. In the first five months of 2015 Poland reached a trade surplus at the level of 11.96 billion PLN. In a sense, this success was an outcome of the crude oil prices drop on the global markets. According to the Polish National Bank, the value of imported oil fell to the level of 8 billion PLN in the first quarter, compared to 14.3 billion last year. However, it was the increasing input of the local exporters that was key to reaching the trade surplus.

Due to the zloty having a negative impact on the foreign trade balance since the middle of 2014, the pace of the deficit reduction has gradually decreased. However, the exporters still managed to reach a positive trade balance. This is a good testimonial of their strong position on the global markets. If this tendency is maintained, then the chance for keeping the surplus of the export over the import will be small.

Today it is clear that the high zloty rate is an obstacle for exporters. In the last several months sales in Scandinavian countries and Central and Eastern Europe have fallen significantly. At the same time, the benefits of the increasing value of the zloty in relation to the countries to which Poland exports goods is not big enough to compensate for the potential losses caused by the possible decrease in export. The best representation of it is the situation with petrol prices, which are failing all over the world. Despite the fact that the prices are at a five-year-low, in Poland the petrol has become more expensive lately.

After a temporary weakening, the Cinkciarz.pl Zloty Index strengthened again. This was accelerated by resolving the crisis in Greece. At the beginning of July, Athens settled for the reforms in exchange for the help program. Thanks to this, the country avoided exiting the eurozone and the zloty strengthened again.

The success of Polish exporters on the global markets are unfortunately wasted by the unfavourable zloty rate. Along with the Polish currency exchange rate going up, the chance of maintaining the trade surplus is decreasing. As a result, the economic growth does not represent the achievements of the Polish entrepreneurs. Thus path to the German prosperity based on the export is getting harder.