The dollar declined for a second day in a row after Donald Trump has threatened that he could introduce additional tariffs on Chinese products if he wants. This statement seems to have a negative impact on the market sentiment and to maintain the odds of interest rate cuts in the US this month.

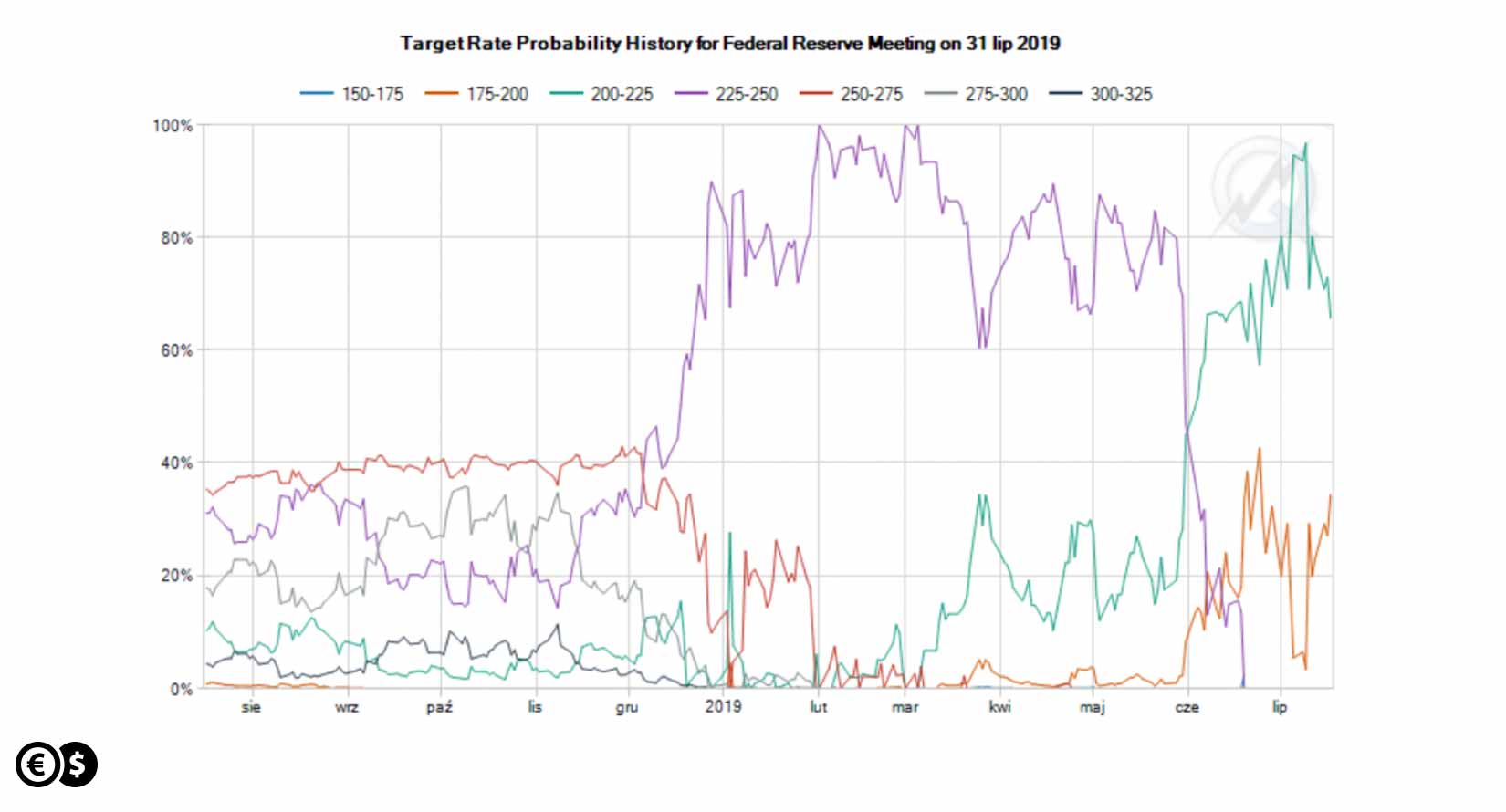

In general, the probability of interest rate cuts by the Federal Reserve of the United States on July 31 is 100 percent. Market participants are trying to price the size of the cut – will the Fed cut interest rates by half a percentage point or a quarter. Currently with the probability of 61 percent investors assume a cut of 25 basis points. 39 percent are the odds of a 50 basis point reduction. It is worth adding that at the beginning of the month the probability of cutting by half a percentage point was about 3 percent. A rise in less than three weeks to 39 percent seems significant. In addition, this is the highest probability of a 50 bp cut since the end of June.

The change of probabilities of interest rate cuts in July in the US. Source CME Group

It seems that the greater the odds of cutting by 50 basis points, the more weaker the dollar on the currency market. What's more, non-commercial investors (speculators) on futures contracts for a dollar for many weeks systematically reduce their bets on long positions, those that can gain when the dollar strengthens. According to the data from July 2, they were the least since June 2018 – according to the CFTC. Therefore, the reduction of long positions may also be an indication that even institutions do not see such potential in USD as before.

Currently, every data from the American economy along with statements of politicians and Fed representatives should be closely watched, as they may influence the market calculations regarding the scale of the July cut and thus may affect the American currency. There are many arguments for its weakness, but the dollar remains strong after all.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.