The American currency has had a very successful 2018 and the first half of 2019. During this time, the USD index futures contract increased by almost 12 percent to the round level of 100 points. However, since April, the index has had more and more problems with continuing earlier increases.

The Dollar index is a weighted geometric mean of the dollar's value relative to following select currencies: Euro (EUR), 57.6% weight, Japanese yen (JPY) 13.6% weight, Pound sterling (GBP), 11.9% weight, Canadian dollar (CAD), 9.1% weight, Swedish krona (SEK), 4.2% weight, Swiss franc (CHF) 3.6% weight according to ICE (Intercontinental Exchange). Earlier, one of the main factors that contributed to the appreciation of the USD seemed to be likely to further tighten monetary policy by the Fed. However, this bias changed at the end of the year, and now we know that there won’t be any rate hikes. The market and investors are now bidding for how many interest rate cuts should occur. This, in turn, can hit the US dollar.

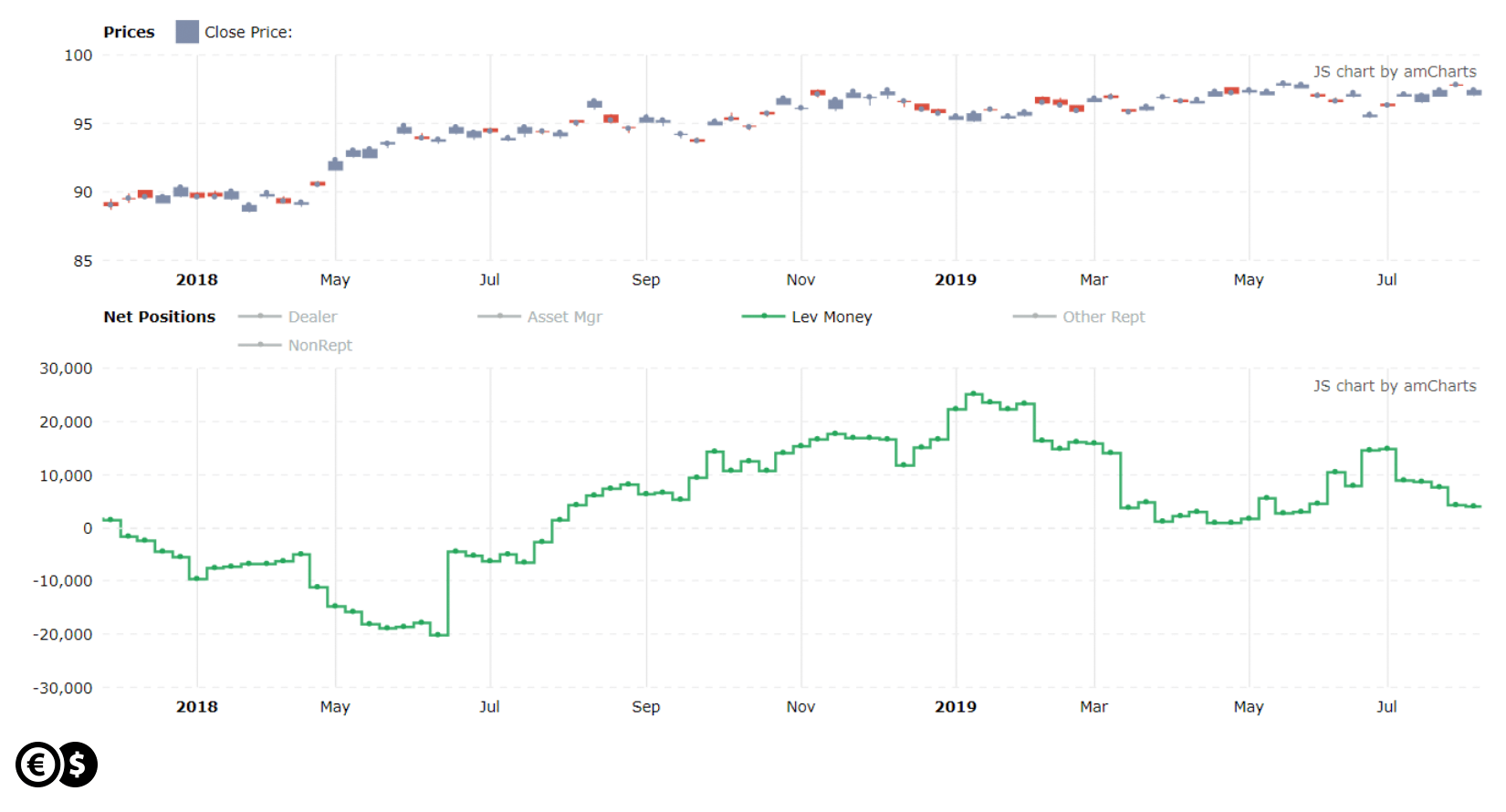

Leveraged funds (speculators) have been reducing their expectations since the beginning of July due to a further increase in the dollar index. Net long positions (difference between long and short positions) fell last week to their lowest level since the end of May. More importantly, the decline occurred along with the rise of the US dollar.

Leverage funds net long positions and USD futures contract. Source: tradingster

The observed discrepancy between positioning and the futures contract can be interpreted as a reluctance to buy contracts at such high prices. What's more, there may be a process of closing previous positions. It is worth noting that the observed discrepancy already forms a total of eight months. At the beginning of 2019, the largest number of net long positions was recorded and since then they began to fall with the dollar still high.

If the dollar were to fall, because, for example, the Fed would ease monetary policy more radically than previously thought, then due to the composition of the dollar index it could have the greatest impact on the EUR/USD currency pair. Here, in turn, thanks to the correlation and relatively small volatility in the EUR/PLN pair, it could also affect the USD/PLN exchange rate, which is trying to turn back from two-year highs.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.