Already yesterday in the morning we saw a greater volatility of many asset classes, which at the end of the day turned into a panicky sale in the global stock market. However, as always, The Wall Street and a powerful risk aversion caught the most attention.

The Dow Jones index fell by 767 points, or 2.9 percent. The S&P 500 fell by 87 points, or 3.0 percent. Nasdaq fell by 278 points or 3.5 percent. This was the worst stock market session this year. Mostly, technological companies were falling, as well as companies with the exposure to the Asian market. The drop in share prices could have accelerated after the President of the United States accused China of currency manipulation, which could exacerbate the conflict. This happened after the Chinese yuan weakened to the level of 7.00 in relation to USD, which was the highest value for almost a decade. In this way, China can increase the attractiveness of its exports, which Donald Trump does not like.

In reaction to the Governor of the People's Bank of China, Yi Gang said China would not use foreign exchange rates as a tool in a trade war. Nevertheless, Treasury secretary Steven Mnuchin will work with the International Monetary Fund to eliminate the unfair competitive advantage resulting from China's recent actions, the statement said. An accusation of currency manipulation may have serious consequences for business, as it may mean imposing penalties on Beijing or breaking important contracts between the US and China.

One can conclude from all this that the most important is currently the yuan exchange rate and its behavior at a politically significant level of 7.00. A further weakening of the Chinese currency could exacerbate the conflict. In turn, strengthening of the yuan can mitigate conflict. With the latter case, we were dealing today at night, when the Chinese currency strengthened in relation to the US Dollar.

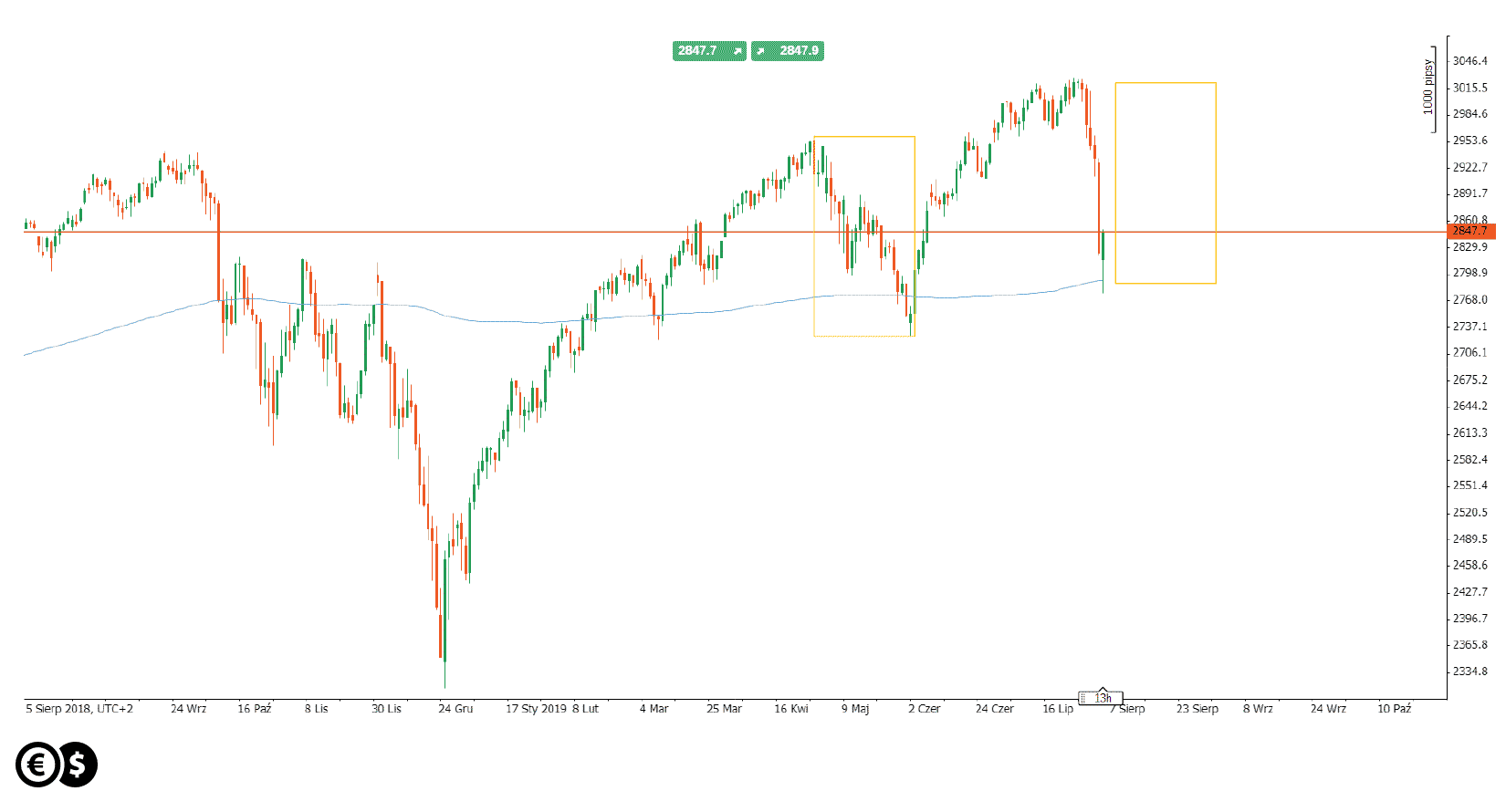

This may have resulted in a very quick reversal in futures contracts on stock indices in Asia, Europe and the United States. The S&P 500 index was in a very interesting place, because both the last sell-off has the same point value as the previous, which appeared in the spring. In addition, the index reached the 200-session average, which is a trend indicator for many investors.

Daily chart of the S&P 500. Conotoxia trading platform

From the point of view of technical analysis, the market tries to defend significant support and only its defeat could change the trend.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.