From the beginning of May to the end of last week (16 August), gold increased by a total of 22 percent, taking into account the lower and higher price in this period. The gold price in US dollar has reached its highest level since April 2013, exceeding USD 1,500 per ounce.

Gold was in demand this year because of the turmoil in the global economy, which seems to be the consequence of the US trade war. The market and investors began to be interested in safe assets, including gold and bonds.

When investors are worried about a recession and bond yields plunged, gold becomes even more attractive. The opinions of financial institutions, such as Goldman Sachs, also make investors look pro-growth at the gold market. According to GS, the bullion price is expected to rise to USD 1,600 per ounce within six months.

We also observe the demand for gold through the increase in purchases of ETFs, which are gold-backed. The increase in total known ETF holdings has already reached 1,000 tonnes since the beginning of 2016. The total amount of gold owned by ETFs increased this week to 2444.9 tons, which is the highest value since 2013 - according to Bloomberg data. However, when everyone is eager to buy a financial instrument and expect its price to rise further, one should be careful.

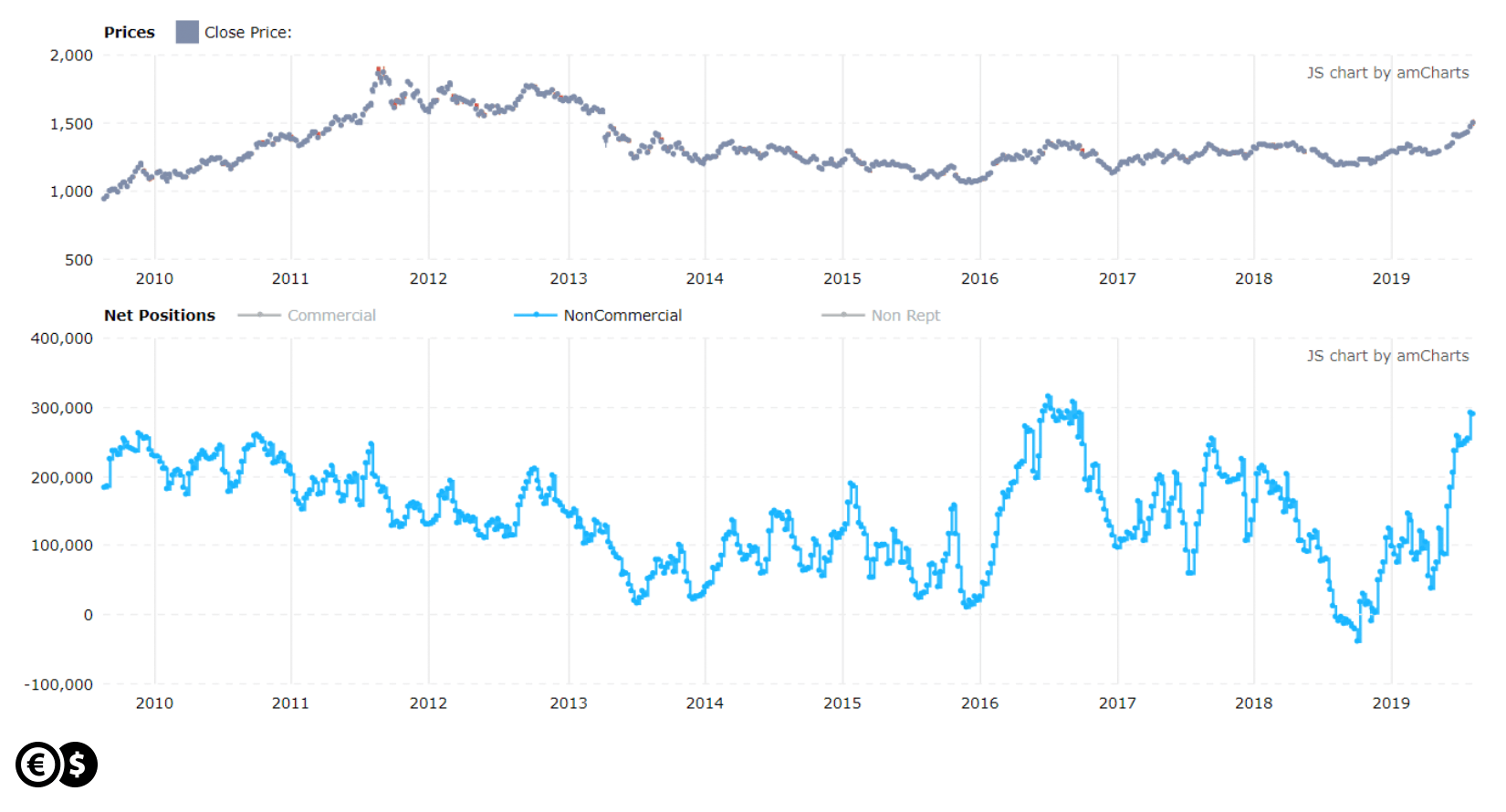

Such a conclusion results from the positioning of investors on the gold futures market. Non-commercial investors gradually increased their involvement in long positions, which allowed them to earn on rising gold prices. They have more than doubled long positions since the end of 2018. As a result, net long positions (difference between long and short positions) increased to the highest level since September 2016.

Price of gold and non-commercial net long positions. Source: tradingster.com

In the last decade, only once was the net position so high. From this point of view, the gold futures market may reach overbought levels. The level of overbought is a place where there are no new buyers, because the prices are too high. This, in turn, can lead to the „long squeeze", and thus quickly closing long positions and taking profits. This is what should be considered now in the gold market.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.