The major currency pair EUR/USD is waiting for the most important events of the week, i.e. the publication of the minutes after the last meeting of the US Federal Reserve (Wednesday, August 21 at 8pm) and for the speech of Fed Chairman Jerome Powell at the symposium in Jackson Hole (Friday, 23 August at 4pm).

EUR/USD reached the lowest level since the end of July amid deteriorating macroeconomic data from the euro area and falling inflation. As a consequence, this increases the chances of substantial monetary easing by the European Central Bank in September and these expectations seemed to put pressure on the euro. However, investors expect that on September 18 the Fed will also decide to cut interest rates by 25 basis points, but earlier significant events may occur during the mentioned symposium of central bankers.

The fx options market, which can value volatility and potential threats (because it can serve as a place where you can insure yourself against unfavorable moves on the underlying market), indicates the possibility of a fall of the EUR/USD. The behavior of the options market indicates the possibility of falling EUR/USD below 1.1000 by the end of August. The chances for such a decrease have tripled since the first half of August to 49 percent. – results from the Bloomberg option pricing model.

Nevertheless, despite the increasing bearish sentiment on the EUR/USD currency pair on the options market, volatility remains relatively low. This means that investors in the options market do not assume that the Jackson Hole symposium will bring something special and shake up the markets.

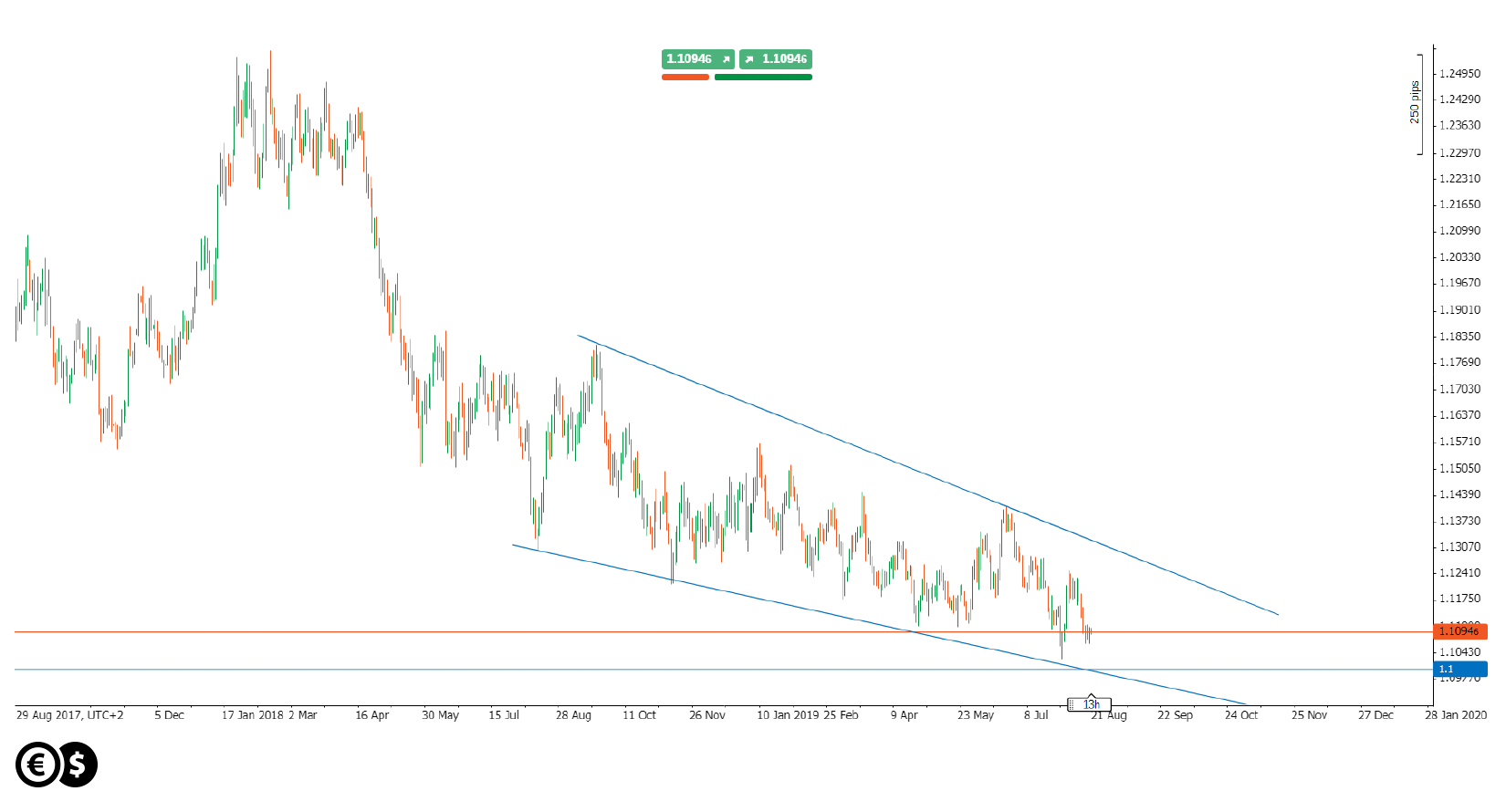

EUR/USD daily chart. Conotoxia trading platform

On the chart, the EUR/USD exchange rate has been creating a potential descending wedge pattern for a year. In this formation, its upper and lower limits converge, and the market reduces its range of fluctuations. Thus, the level of 1.1000 may be another possible support. In turn, a change in trend could occur only when the upper limit in the described pattern is broken. However, this is still far from the current EUR/USD rate.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.