The EUR/USD reached the highest level last week since the second half of March this year. As a result, the potential level of resistance at 1.1263 were broken. This level may currently be the first support for this currency pair. Due to a strong correlation with the EUR/USD, the zloty also gained and strengthened last week to PLN 3.75.

The depreciation of the American currency, whether in relation to the euro or in relation to the zloty, seems to result from a series of weaker data from the US economy. It is about PMI and ISM readings or recent data from the labor market. Both the ADP report and the NFP indicated a much lower change in employment and a lower increase in the average hourly earnings than the market expected. All this could raise investors' expectations regarding the cycle of interest rate cuts in the US. After Friday's data, the interest rate market started to price up three cuts this year. Also, financial institutions began to talk about such a possibility more and more often. Barclays wrote in its note that it expects to cut by 50 basis points in July and by 25 basis points in September. All this may translate into the weakness of the American currency.

Meanwhile, the Goldman Sachs bank, popular among investors, raised its three-month forecast for the EUR/USD to 1.1500 from 1.1000. Goldman Sachs in its note argues that the euro should strengthen with the following factors: improvement of industrial activity through the growth of German car production. Relatively easy financial conditions, lower oil prices and fiscal stimulus were also indicated as sources of potential support for the single currency. Thirdly, the potential of the more hawkish president of the European Central Bank may influence views on interest rate prospects. Fourthly, the ECB does not have much room for easing monetary policy in relation to the Fed - according to Goldman Sachs.

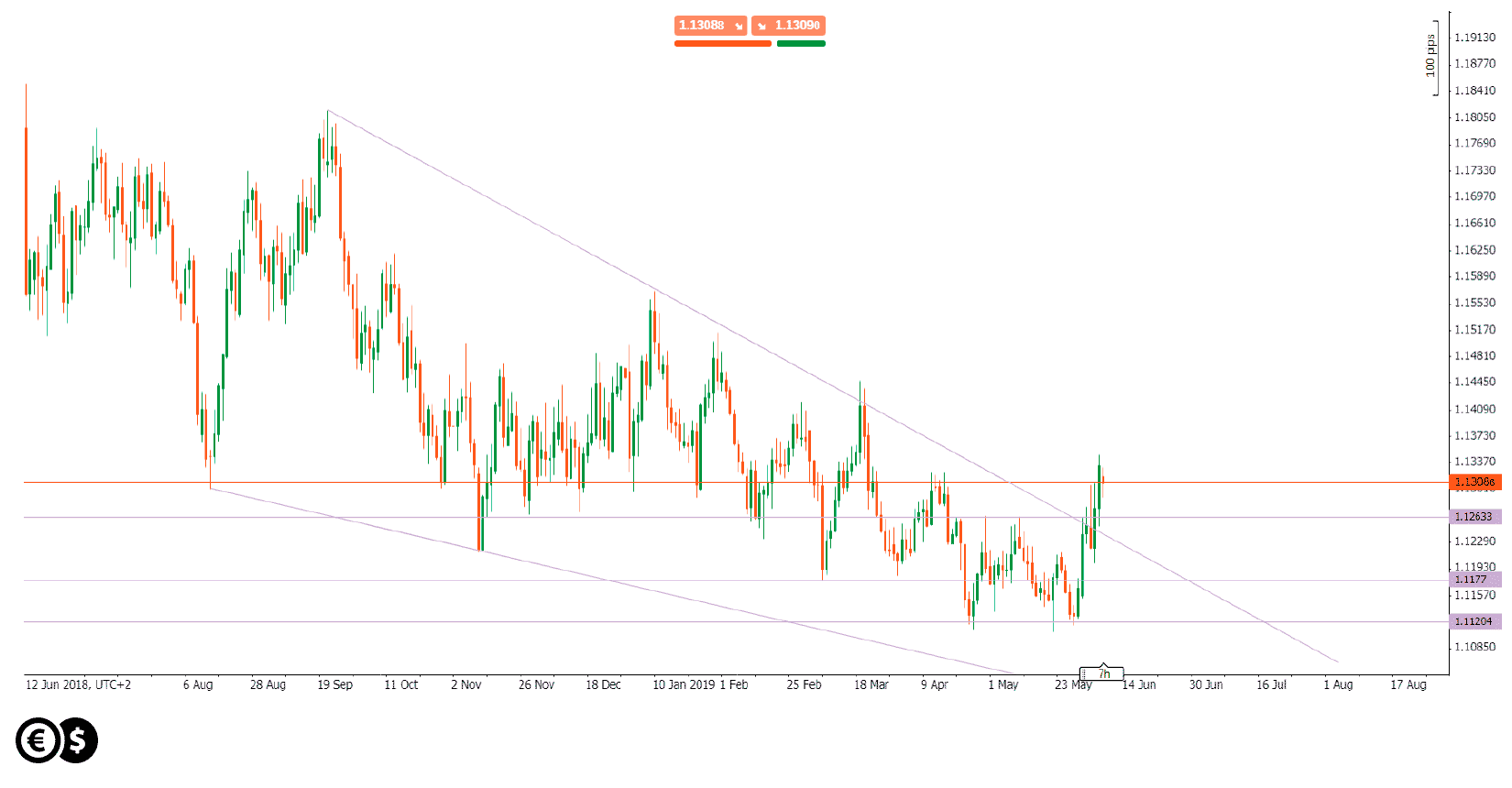

Chart: EUR/USD, D1. Source: Conotoxia trading platform

From the technical point of view the downward trendline has been broken. The EUR/USD also set a new higher high, previously defending key support in the 1.1120 area. In turn, 1.1260 may be the first place of defense for market bulls.

Daniel Kostecki, Chief Analyst Conotoxia Ltd.

Materials, analysis and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the author does not represent and should not be constructed as a statement or an investment advice made by Conotoxia Ltd. All indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

59% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.