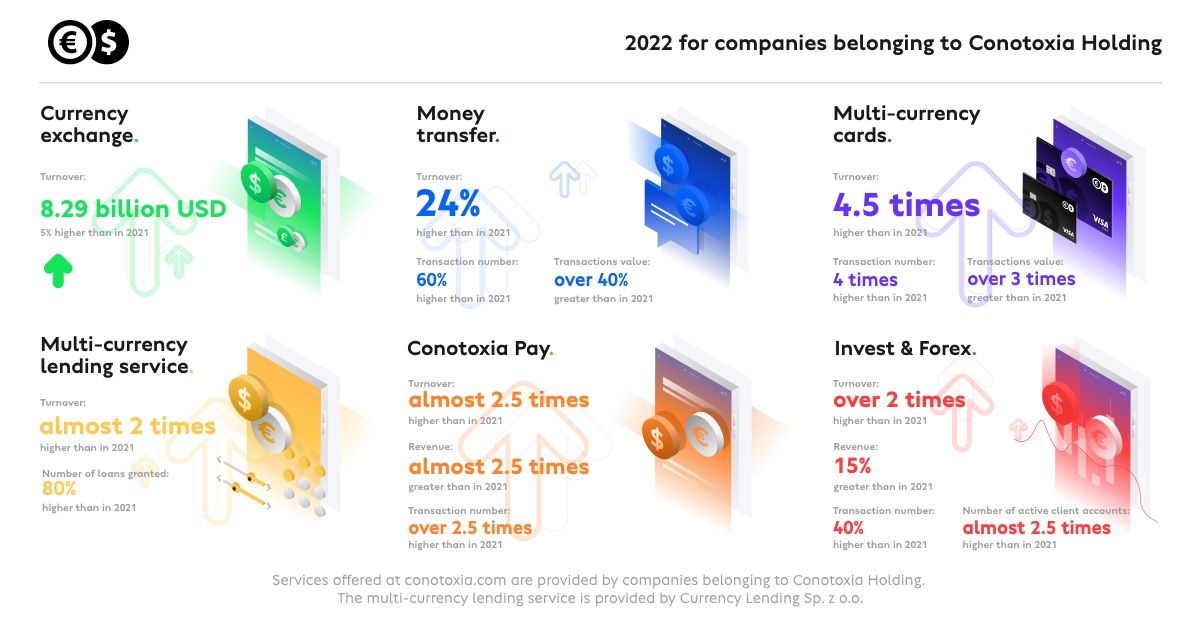

In 2022, Conotoxia Holding once again markedly raised revenues and transaction volumes compared to the previous year. The Group reached a turnover of 8.29 billion USD on foreign exchange transactions, with significant increases for all services offered by Conotoxia Holding companies.

Financial results

In the currency exchange category, the turnover of global fintech increased by 5% in 2022 compared to 2021, reaching 8.29 billion USD.

Revenue from the money transfer service grew by 24%, the number of transactions increased by as much as 60%, and their value jumped by more than 40% compared to the previous year.

In the multi-currency cards category, revenue increased by as much as 4.5 times compared to 2021. The number of card transactions rose 4-fold, and their value went up more than 3 times.

Turnover on lending service increased by almost 2 times in 2022, and the number of granted loans grew by 80%. The significant increase refers to loans in foreign currencies, which were granted almost 2.5 times more than in the previous year.

The best results ever also come from the B2B segment. Business customers are more and more willing to use the fintech payment system for e-commerce - Conotoxia Pay. Both revenue and turnover increased almost 2.5 times in 2022 compared to 2021. During this period, the number of transactions went up by more than 2.5 times.

Conotoxia Ltd., which provides investment services on Conotoxia.com, is reinforcing its position among brokers in Poland and abroad. The company noted in 2022 a more than 2-fold increase in revenue, a 15% higher turnover and 40% more transactions compared to the previous year. The number of active client accounts reached an all-time high, increasing by almost 2.5 times.

"It is essential for us to consistently expand in all areas of our business. Conotoxia’s offer makes it possible to manage everyday finances in various currencies conveniently, quickly and universally. Our group is working hard on other projects, both at home and abroad. We are planning further international expansion and expect to see significant growth in revenue and turnover in all segments. We want to reaffirm the position of the leader in multi-currency services in Poland also globally," said Marcin Pioro, CEO of Conotoxia Holding.

Novelties on offer

Conotoxia has constantly been innovating and investing in the development of its offering. In 2022, fintech provided its customers with a number of products and services. Among the main innovations are:

- Launch of multi-currency card 2.0 with an option to share the cards with others;

- Enabling Apple Pay for multi-currency card users;

- Providing the option to withdraw a loan not only to a bank account but also to a multi-currency card and to collect the funds automatically on the repayment date;

- Releasing the Conotoxia app for Apple devices;

- Introducing a money transfer service for business customers, integrated with their system through an API;

- As part of the payment system, Conotoxia Pay already serves company customers from dozens of countries, enabling them to expand internationally;

- Provision of the BLIK Level 0 option in Conotoxia Pay, allowing customers to pay for orders without leaving the online shop;

- Introduction of further payment methods: available on the web portal (Vipps) and in the Conotoxia Pay (Rapid Pay, Vipps);

- Further advances in the use of artificial intelligence in the form of ChatGPT, assisting with customer service and marketing activities;

- Offering investment clients more than 5,000 financial instruments from 9 asset classes (including CFDs on currencies, indices, commodities and raw materials; futures, cryptocurrencies, equities and DMA stocks, ETFs, as well as DMA ETFs from Asia, Europe and the US), which is one of the broadest offers on the Polish market.

Services offered at conotoxia.com are provided by companies belonging to Conotoxia Holding. The multi-currency lending service is provided by Currency Lending Sp. z o.o.