The second quarter can be the most beneficial time to exchange Polish currency with the euro or the dollar- as evidence from exchange rate analyses have shown over the past few years.

However, the foreign exchange market is sensitive and does feel internal and external stimuli. So, what has been observed isn’t always enough to use as a tool in order to limit currency risk - writes Bartosz Grejner, the analyst of Cinkciarz.pl.

How to avoid an unfavourable moment regarding currency exchange? If we have a closer look on how the exchange rates of the dollar and the euro have changed in relation to the zloty, some seasonal patterns can be noticed.

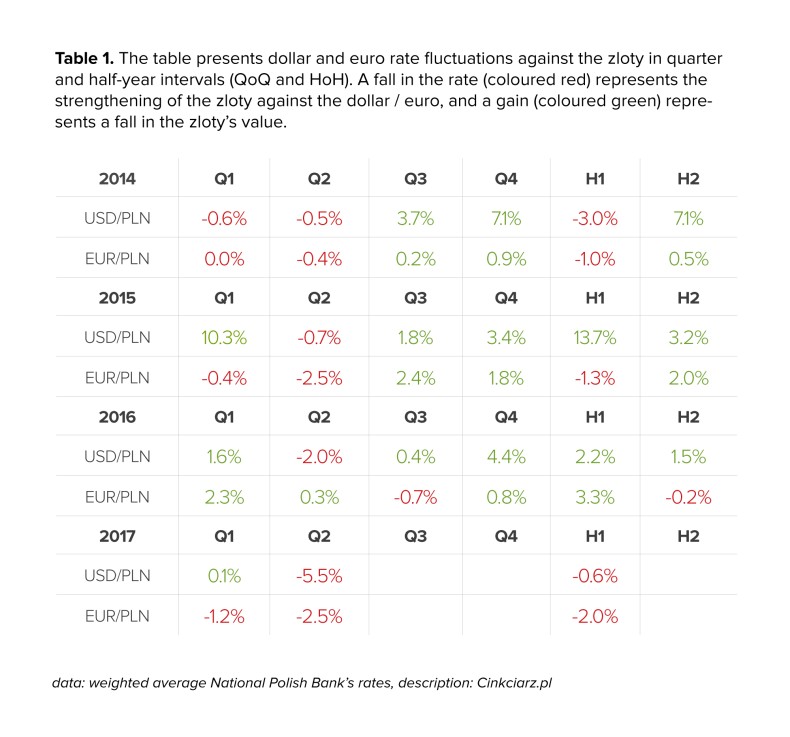

The semiannual analysis shows that the second part of the year's exchange rates of the dollar and the euro (expressed in PLN) were slightly higher than they were in the first half of the year. Looking deeper, on a quarterly basis, it can be noticed that the second quarter was the most favourable for buyers of both currencies, especially in the last three years. The recently ended quarter has only confirmed the aforementioned rule. Until May, the zloty was the strongest appreciating currency in the world (according to Bloomberg), and it gained against both the euro and the dollar.

The second quarters analysed were also characterised by the euro’s lower volatility when compared to the dollar. At the same time, the range of fluctuations in the European currency market were generally small compared to, for example, how the value of the American currency has changed.

Except for the first quarter of 2012, when the average EUR/PLN exchange rate (in comparison to the previous quarter exchange rate) fell by 4.2%., the quarterly fluctuations in the past five years were between -2.8 percent and 2.4%. In the case of the dollar, if we omit the unusual increase of 10.3% (Q/Q) in the first quarter of 2015, the quarterly changes of USD/PLN ranged from -4.2%. to 7.1% This is a range of 11.3 pp, which is two times greater than the range of the euro changes that amounted to 5.2 pp, omitting the extreme.

Since the relations of the zloty and the dollar are much more volatile than those of the euro, the foreign exchange risk has become significantly higher for the US currency than for the euro.

The minimum quarterly deviation of the dollar in the analysed fourth quarters (see table) amounted to 3.4%, while the euro was barely 0.6%. Even more volatility was observed in 2012 and 2013 when the USD/PLN exchange rate fell by 4.2%, and in the next three rose from 3.4% to 7.1%. Therefore, the exchange of dollars in the fourth quarter may be riskier than during the rest of the year.

Historical changes and loads of other factors

While the historical changes of the dollar and the euro against the zloty may provide a valuable guide on convenient moments to buy or sell currencies, one should not rely on them exclusively. It’s important to know that currency quotes depend on many, often unpredictable, factors. These include central bank policies in particular countries; most importantly, what the interest rate levels and the prospects for their changes are. The macroeconomic situation is also of the essence, especially in regards to the inflation rate, economic growth, labour market and current political events.. The latter, particularly in recent quarters, was one of the main factors behind the increased fluctuations in the currency due to Brexit, Donald Trump's election to the US presidency, and the presidential election in France, to name a few.

Limiting the risk is essential

Current analyses of economic and political events, with reference to seasonal dependencies, may be helpful in selecting optimal exchange rates. However, when there is no time to observe market trends, the currency risk can be reduced in another way: by dividing the amount and spreading the exchange of a currency over several stages over a longer period of time. As a result, the final exchange rate will be averaged and therefore will be less susceptible to significant fluctuations.

Splitting currency exchange into installments and phases combined with seasonal change knowledge can increase the chances of getting a good exchange rate. Example? When buying dollars or euros, more of our transactions should be realised in the second quarter of the year and the smaller part left for the next two quarters. If one was mostly concerned about the reduction of the dollar’s exchange rate volatility, exchanging the largest portion of money in the last quarter of the year is risky.

However, regardless of the reason for exchanging euros or dollars, it is crucial to bear in mind that the currency market is very sensitive. Therefore, the reduction of the currency risk should be the target instead of the urge to make a profit.